[The Economy in Crisis, The Way Out]

③ Kim Yonghwan, Former Chairman of NH Nonghyup Financial Group

Led the front lines as Senior Deputy Governor of the Financial Supervisory Service during the 2008 financial crisis

When foreign capital outflows occurred, the Korea-US currency swap alone was insufficient; additional Korea-China and Korea-Japan agreements were necessary

The COVID-19 crisis is an opportunity for industrial restructuring... The Corporate Financial Improvement Support Group should be revived to facilitate restructuring

Kim Yong-hwan, former Chairman of NH Nonghyup Financial Group

Kim Yong-hwan, former Chairman of NH Nonghyup Financial Group

Since the Great Depression in the 1930s, the global economy has experienced several crises. These include the 1970s oil shock, the early 2000s IT bubble burst, the 2008 global financial crisis, and the 2011 advanced countries' fiscal crisis. In 2016, there was also an emerging market financial crisis centered around countries like Turkey and Argentina.

The commonality in past crises is that financial sector failures triggered real economy downturns, leading to economic recessions. In contrast, the current crisis caused by the novel coronavirus infection (COVID-19) pandemic is characterized by a so-called 'dramatic collapse,' where both the financial sector and the real economy simultaneously fall into panic, unlike previous patterns.

In other words, this crisis is a complex demand and supply shock layered on a global low-growth phase caused by low interest rates, aging populations, and global trade wars, making it possible for the economic recession to persist.

This means that new types of solutions are needed that cannot be resolved by past learning experiences.

First, the government must swiftly and decisively implement fiscal policies such as supplementary budgets and the previously announced 100 trillion won plus alpha financial stabilization measures effectively. Measures that can be immediately executed through close cooperation between financial institutions and supervisory authorities are necessary, such as establishing bond market funds, securities stabilization funds, and bond collateralized securities (P-CBO) funds for short-term liquidity support to stabilize the financial market.

In particular, procedures should be simplified for emergency management funds for small office/home office (SOHO) businesses, self-employed individuals, and small and medium-sized enterprises (SMEs) and mid-sized companies facing funding difficulties. Export-oriented SMEs and mid-sized companies, and if necessary, large corporations should be actively supported by policy banks such as the Export-Import Bank and the Korea Development Bank.

Recently, quantitative easing measures such as the Federal Reserve in the U.S. and the Bank of Japan's big cuts (large-scale base interest rate reductions), expanding the institutions eligible for bond purchases (repurchase agreements), and broadening the types of bonds purchased are considered appropriate for the Bank of Korea. Going forward, in unprecedented crises like COVID-19, the Bank of Korea should prepare even more bold additional quantitative easing measures.

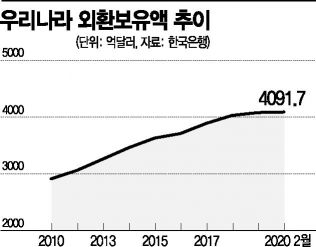

Alongside this, expanding foreign currency liquidity must also be considered. Although current foreign exchange reserves exceed 400 billion dollars, double that of the 2008 financial crisis, the situation changes if foreign capital, which accounts for 55% of the capital market, flows out. Recently, a 60 billion dollar Korea-U.S. currency swap has provided a safety net for the foreign exchange market. However, additional currency swap agreements with countries involved in corporate supply chains such as Korea-Japan and Korea-China are also necessary.

Furthermore, to secure global liquidity, diversification of issuing countries, currencies, and overseas bonds is required. For example, like the Export-Import Bank, it is necessary to diversify borrowing markets beyond reliance on dollar bonds to relatively liquid markets such as the Middle East and Japan. During the foreign exchange and financial crises, the government opened paths for corporate foreign currency procurement by issuing Foreign Exchange Stabilization Bonds (Oepyeongchae).

Oepyeongchae serve as milestones demonstrating a country's creditworthiness during external crises. Recently, the Alberta provincial government in Canada issued 300 million dollars of 100-year bonds to respond to COVID-19. The 100-year bonds are practically perpetual bonds with no maturity. Similarly, Korea needs to issue long-term bonds of 30 to 50 years to secure sufficient funds in advance to prepare for foreign currency outflows. Moreover, close international cooperation with multilateral development banks (MDBs) and international credit rating agencies is essential to help them understand Korea's economic situation.

Crisis management must consider the post-crisis situation as well. This crisis should be taken as an opportunity for industrial restructuring. Missing the timing for restructuring now will weaken survival capabilities during crises and resilience during recovery. Through detailed diagnosis by industry, it is necessary to distinguish the wheat from the chaff and concentrate support on sectors that can contribute to society and the economy after the crisis.

To this end, the revival of the Joint Corporate Financial Improvement Support Group of the Financial Services Commission and the Financial Supervisory Service, which operated temporarily during the 2008 financial crisis, is necessary. The Support Group conducted restructuring of about 200 companies, including construction and shipbuilding firms. After banks identified viable companies, they intervened through financial structure improvement agreements or voluntary arrangements. There are limits to restructuring led mainly by creditors as is currently the case.

However, more diverse participation from government ministries than in the past is required. A collaborative system involving ministries with various perspectives, such as the Ministry of Economy and Finance from a growth standpoint, the central bank from a market stability perspective, and financial authorities, should be established. In this process, financial authorities should act as the hub to execute measures swiftly and decisively. Additionally, an environment such as indemnity systems should be created to enable banks to smoothly provide funds to companies.

Finally, active participation in medical cooperation such as treatment and vaccine development discussed at the recent Group of Twenty (G20) meeting, coordinated macroeconomic policies, strengthening global financial safety nets, and exchanges of essential personnel like scientists and doctors is necessary to contribute to overcoming the crisis.

We are currently facing a global Black Swan situation. Since no one knows the extent of COVID-19's impact, the crisis has not even fully begun yet. It is necessary to devise solutions that maximize the use of resources held by all economic actors?government, private sector, and companies?to generate complex synergies.

Kim Yong-hwan, Former Chairman of NH Nonghyup Financial Group

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.