[Asia Economy Reporter Kim Daeseop] The Ministry of SMEs and Startups announced on the 30th that it will increase the guarantee scale related to the novel coronavirus infection (COVID-19) with the Korea Technology Finance Corporation (Kibo) to about 2.2 trillion KRW.

This expansion of the guarantee scale is planned to be implemented from the 1st of next month through supplementary budgets and internal resources to resolve the financial difficulties of technology SMEs and small business owners caused by the impact of COVID-19.

The Ministry of SMEs and Startups and Kibo will fully extend the maturity of all guarantees (about 5.8 trillion KRW) maturing from April to June this year. For small business owners, they plan to expand the guarantee-eligible technology evaluation grades and provide rapid support through simplified evaluation and screening.

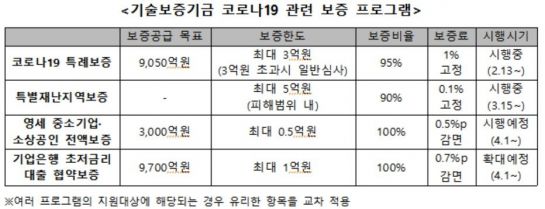

Kibo's COVID-19 special guarantee was significantly expanded from 105 billion KRW to 905 billion KRW following the passage of the supplementary budget on the 17th. Among this, 300 billion KRW has been separately allocated to support companies located in Daegu and Gyeongbuk.

In particular, following the declaration of Daegu, Gyeongsan, Cheongdo, and Bonghwa in Gyeongbuk as special disaster areas on the 15th, companies confirmed as affected businesses in these regions will have their guarantee limits applied up to 500 million KRW (within the damage range), and the guarantee fee will be set at the lowest level of 0.1%.

The Ministry of SMEs and Startups and Kibo have also expanded the COVID-19 special guarantee support targets from certain industries such as travel and performances to all affected industries. They included companies manufacturing and supplying medical and quarantine-related goods and services in the support targets to provide funds for the prompt overcoming of COVID-19.

The full guarantee for micro SMEs and small business owners announced at the emergency economic meeting on the 19th will be implemented from the 1st of next month with a scale of 300 billion KRW targeting companies with annual sales under 100 million KRW. The guarantee limit is 50 million KRW, the guarantee ratio is raised to 100%, and even companies currently using existing guarantees can receive this guarantee, focusing support on companies needing small emergency funds.

The Industrial Bank of Korea’s ultra-low interest loan agreement guarantee is a guarantee product provided to small business owners and self-employed individuals (individual enterprises). Originally planned at 180 billion KRW this year, the scale will be increased more than fivefold to 970 billion KRW. Additionally, the guarantee ratio will be raised from 90% to 100%, and the guarantee fee reduction will be expanded from 0.4 percentage points to 0.7 percentage points, easing the financial burden on small business owners and self-employed individuals struggling due to COVID-19.

Along with the 2 trillion KRW scale technology guarantee supply, the Ministry of SMEs and Startups and Kibo will also relax evaluation and screening criteria for rapid guarantee supply. They decided to fully extend the maturity of long-term and high-amount companies, which were previously excluded from maturity extension measures, among mandatory repayment companies. However, some companies such as those that have closed or suspended business or failed to fulfill responsible management obligations are excluded.

Furthermore, to ensure rapid guarantee supply, evaluation and screening criteria will be significantly relaxed. For small business owners, the guarantee-eligible technology evaluation grade will be lowered from the previous 6th grade (B) out of 10 grades to the 7th grade (CCC), expanding the support target. A simplified evaluation model at the checklist level will be applied to enable rapid support.

A Ministry of SMEs and Startups official said, "To enable companies to receive guarantees quickly, we are minimizing inconvenience by shortening the time required for guarantee support by more than two days compared to other guarantees through non-visit guarantee systems and simplification of submission documents."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.