The Credit Risk Assessment Mitigation Section to Be Early Implemented from June

[Asia Economy Reporter Kim Eunbyeol] The novel coronavirus infection (COVID-19) has also delayed the introduction of the revised 'Basel III,' an internationally accepted bank capital regulation. Since COVID-19 has become a pandemic, the intention is for banks to focus on domestic financial support and lending rather than struggling to meet the new standards.

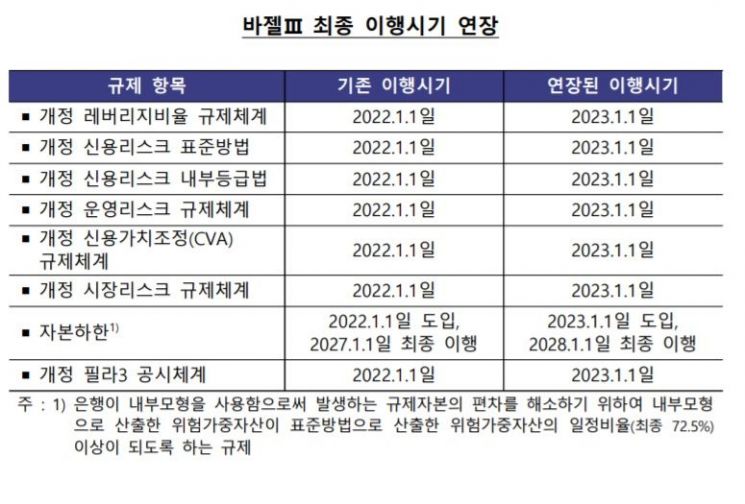

According to the Bank of Korea and others on the 30th, governors of major central banks and heads of supervisory authorities (GHOS) agreed to postpone the final implementation date of the Basel III regulatory framework from January 2022 to January 2023. A Bank of Korea official stated, "The Basel Committee on Banking Supervision (BCBS) reviewed the proposal to delay the Basel III implementation schedule and reported it to GHOS. GHOS members, including Governor Lee Ju-yeol of the Bank of Korea, approved it through an email voting process."

GHOS is the highest decision-making body that determines the main directions of the Basel Committee on Banking Supervision (BCBS) and oversees its operations. The Basel III regulatory reforms were completed at the end of 2017, and the market risk regulatory framework was revised and announced on January 15 last year. Following this decision, GHOS members can extend the final implementation date of the Basel III regulatory framework by one year.

Lee Seung-yong, head of the Financial Regulation Team at the Financial Stability Bureau of the Bank of Korea, said, "With the extension of the final implementation date of the Basel III regulatory framework, the regulatory compliance burden on domestic banks will be eased, allowing for strengthened financial service support to respond to COVID-19." This means that operational resources previously mobilized to comply with the new framework can be redirected to support other financial services such as lending. Lee added, "Due to COVID-19, banks have increased remote workforces and face difficulties in managing outsourced IT personnel, so delaying the implementation date can alleviate banks' burdens."

However, financial authorities decided to advance the implementation of parts related to Basel III credit risk assessment by six months. According to the revised Basel III regulations, the credit risk assessment includes lowering the risk weights for small and medium-sized enterprise (SME) loans and reducing loss given default rates for some corporate loans. This reduces banks' capital regulation compliance burdens on corporate loans, providing an incentive to supply more funds to companies.

The Financial Services Commission announced on the 27th, "To strengthen banks' support capabilities for companies facing difficulties due to the spread of COVID-19, the Basel III final rules will be implemented early starting from the second quarter of this year."

Until now, when banks lent money to SMEs, a 100% risk weight was applied to the loans. Generally, domestic SMEs do not receive credit ratings from credit rating agencies, so most have no rating. Lending to unrated companies increases risk assets, which lowers banks' BIS ratios (capital adequacy ratios), creating a burden. However, under the revised framework, the risk weight for loans to unrated SMEs is eased from the existing 100% to 85%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.