Bank of Korea '2019 Short-term Financial Market Review'

[Asia Economy Reporter Kim Eunbyeol] The size of South Korea's short-term financial market, including call loans, repurchase agreements (RP), negotiable certificates of deposit (CD), commercial paper (CP), and short-term bonds, showed a high level of growth last year.

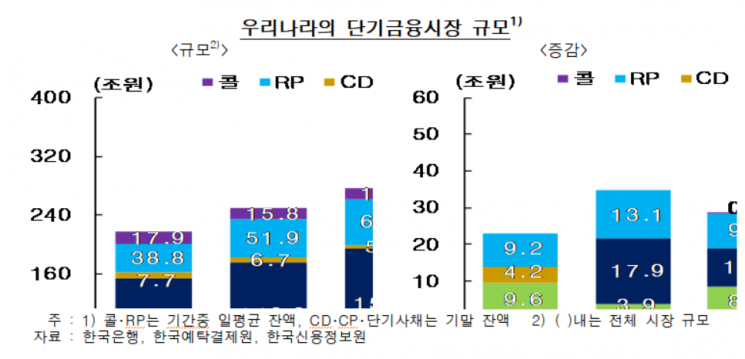

According to the "2019 Short-term Financial Market Review" released by the Bank of Korea on the 30th, as of the end of December last year, the size of the short-term financial market was 355 trillion won, an increase of 53 trillion won (17.5%) compared to 302 trillion won in 2018. This represents the highest growth rate since 2013.

By market segment, the CP and RP markets led the growth of the short-term financial market, increasing by 24.1 trillion won (+15.2%) and 17.2 trillion won (+22.8%) respectively compared to 2018. The short-term bond and CD markets also grew by 8.8 trillion won (+19.1%) and 4.5 trillion won (+51.7%) respectively.

In particular, the CP market expanded due to banks' demand for time deposits to comply with the new loan-to-deposit ratio regulation, leading to increased issuance of SPC time deposit asset-backed commercial paper (ABCP). The RP market saw a significant increase compared to 2018 due to the expansion of bond-type hedge funds and securities firms' bond investments. The call market, however, recorded a decrease of 1.8 trillion won (-13.3%) following a decline of 2.8 trillion won (-17.3%) the previous year, due to banks' regulatory ratio compliance and the expansion of RP operations driven by interest rate advantages.

While the call market size has continued to decline since the phased restrictions on non-bank financial institutions' participation in the call market began in 2010, the RP market has shown rapid growth as a funding market for non-bank financial institutions.

Until 2015, the call market decline was mainly centered on non-bank financial institutions, but after the completion of institutional reforms, banks' call transactions steadily decreased, leading the overall contraction of the call market. This is attributed to the introduction of asset management companies' call loan limits, which restricted banks' funding from non-bank financial institutions, and regulations such as the Liquidity Coverage Ratio (LCR) that reduced banks' short-term funding, resulting in decreased call money transactions. Additionally, banks' increased operation of temporary surplus funds in RP with higher interest rate merits also contributed to the contraction of call loan transactions.

Meanwhile, the RP market expanded significantly as securities firms and asset management companies using leverage investment strategies continued to grow bond-type hedge funds and securities firms expanded their assets, greatly increasing funding through RP sales. Furthermore, the lower funding cost of RP compared to other funding methods for non-bank financial institutions also contributed to market expansion.

A Bank of Korea official stated, "The recent reforms in the short-term financial market appear to have contributed to mitigating credit risk in the call market, strengthening its role as a bank funding adjustment market, and establishing the RP market as a funding market for non-bank institutions." However, the official added, "It is necessary to monitor whether the continued reduction in call transactions leads to side effects such as a decline in the market's price discovery function."

Additionally, the official analyzed, "Despite rapid quantitative growth, the domestic RP market poses risk factors from a financial stability perspective. Since the introduction of hedge fund transactions, securities firms have increasingly sought profits by raising funds through RP sales."

Meanwhile, the new loan-to-deposit ratio regulation, implemented from January this year to curb household loans and expand corporate loans, also affected the domestic short-term financial market.

In response to the new loan-to-deposit ratio regulation during 2019, banks strengthened efforts to increase deposits, which are relatively easier to expand than reducing loans. In this process, banks increased funding through CDs and time deposits rather than call borrowings. As a result, the average daily balance of call borrowings by domestic banks in 2019 was 5 trillion won, down from 6.6 trillion won in 2018, while CD issuance rose 41.5% to 30.1 trillion won in 2019 from 21.3 trillion won in 2018. Additionally, due to banks' large demand for time deposits, SPC issuance of time deposit ABCP expanded significantly. General banks' time deposits increased by 56.4 trillion won in 2019 compared to 2018, of which 40%, or 22.1 trillion won, was raised in the form of time deposit ABCP.

A Bank of Korea official said, "This year, the impact of the new loan-to-deposit ratio regulation on the short-term financial market is expected to be limited compared to 2019, as banks are already complying with the regulation, reducing incentives for CD issuance, and time deposits remain high-cost funding, making it difficult to maintain the same growth trend as in 2019."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.