[Asia Economy Reporter Eunmo Koo] Nike is continuing its growth despite the impact of the novel coronavirus (COVID-19), driven by an increase in online sales.

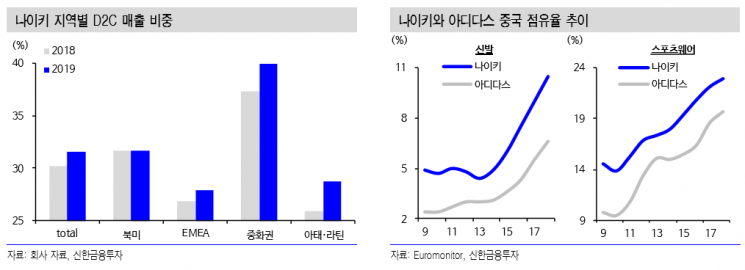

According to Shinhan Financial Investment on the 29th, Nike's fiscal year 2020 third-quarter revenue and earnings per share (EPS) recorded $10.1 billion, up 7% year-over-year, and $0.53, down 22%, respectively. These results exceeded the consensus estimates of $9.6 billion and $0.52. Hyunji Lee, a researcher at Shinhan Financial Investment, analyzed in a report that day, "The increase in direct-to-consumer (D2C) sales offset the performance decline caused by offline store closures, dispelling market concerns." Digital sales for this quarter increased by 36%.

By region, North America posted $4.0 billion in sales, up 4% year-over-year; Europe, Middle East, and Africa grew 13% to $2.7 billion; and the Asia-Pacific and Latin America regions increased 13% to $1.4 billion. Conversely, China, which had maintained high growth, saw a 4% decrease to $1.5 billion, marking a contraction for the first time in 22 quarters. However, the researcher evaluated that "considering that 75% of Chinese stores were temporarily closed at the end of January, a 4% decline is a relatively good performance." By product category, footwear sales rose 5% to $6.4 billion, apparel grew 9% to $2.9 billion, and sports equipment increased 6% to $300 million. Both footwear and apparel sales showed solid results due to the steady popularity of Jordan products.

Nike did not provide guidance for the fourth quarter due to uncertainty regarding the timing of store reopenings and the impact on performance. Currently, stores in the United States, Canada, Western Europe, and Australia are temporarily closed. It was mentioned that sales in China are expected to maintain the level of the previous year's fourth quarter. Approximately 80% of Chinese stores have resumed operations and are in the process of sales recovery.

As the competitiveness of the D2C platform is highlighted, market share expansion is expected. The researcher stated, "Although profit decline due to COVID-19 is inevitable and exposure to market volatility is concerning, the price attractiveness has increased due to the global stock market adjustment," and added, "Based on the competitiveness of the D2C platform emphasized by COVID-19 and the expectation of further market share expansion, we recommend an active overweight position."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)