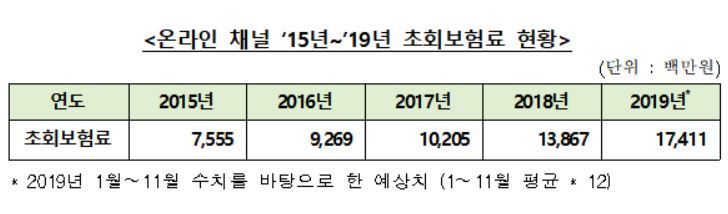

Initial Online Channel Insurance Premium

Increased by 130.5% in 4 Years

[Asia Economy Reporter Ki Ha-young] Due to the spread of the novel coronavirus infection (COVID-19), insurance subscriptions through non-face-to-face online channels are gaining attention. As the number of subscribers through online channels increases with affordable premiums and simple subscription procedures, insurance companies are also expanding customer choices by offering various products.

According to the Life Insurance Association on the 28th, the initial insurance premiums through online channels increased by 130.5% over four years, from 7.6 billion KRW in 2015 to 17.4 billion KRW in 2019. The advantage of easy subscription via internet and mobile has recently attracted not only people in their 20s and 30s but also middle-aged and older generations. Recently, new products applying various themes have been released, covering not only mini insurance that guarantees specific diseases and urgent duties but also savings and protection insurance.

Hanwha Life's savings insurance product, 'LIFEPLUS Hyo-do Travel Savings Insurance,' provides everything from preparing funds for filial piety trips to travel services and solutions. The monthly premium starts at 9,500 KRW, and if maintained for just one month, you can receive more than the premiums you paid.

Hana Life's 'Hana 1Q Pension Savings Insurance' allows utilization of tax deductions and mid-term withdrawal functions. It is also possible to increase pension receipts by reducing fees and operating expenses.

Heungkuk Life's protection insurance, 'Online Deulsum Nalsum Health Insurance,' is a mini insurance without maturity refunds, covering ear, nose, and respiratory diseases for men at 1,500 KRW and women at 1,100 KRW. It pays 100,000 KRW per surgery for specific olfactory diseases and ENT diseases, and a one-time payment of 10 million KRW for lung cancer diagnosis.

Mirae Asset Life's 'Online Cerebral Infarction, Cerebral Hemorrhage, Acute Myocardial Infarction Protection Insurance' provides coverage for major adult diseases at affordable premiums. For a 40-year-old male, the monthly premium is 11,500 KRW, covering 10 million KRW each for cerebral infarction, cerebral hemorrhage, and acute myocardial infarction.

There are also mini insurances that cover only specific diseases and urgent duties such as breast cancer and stomach cancer. Chubb Life Insurance's 'Insurance Thinking Only About Breast Cancer' and 'Insurance Thinking Only About Stomach Cancer' have annual premiums of 6,370 KRW and 10,200 KRW respectively for a 30-year-old female. Upon confirmed diagnosis of breast cancer, a one-time payment of 5 million KRW is made, and for stomach cancer diagnosis, a one-time payment of 30 million KRW is provided.

Online insurance products can be subscribed to by accessing each insurer's internet homepage, and product comparisons by company are also possible through the online insurance supermarket 'Boheom Damoa.' While it is easy to subscribe via internet homepage and mobile direct channels, personal authentication through a certified certificate is required instead of a handwritten signature.

Unlike face-to-face channels where agents recommend products, the nature of online channels where customers select suitable products themselves makes understanding insurance essential.

An official from the Life Insurance Association said, "Contractors should accurately compare the coverage and necessary protection for themselves without the help of insurance planners through product descriptions containing important terms and conditions," adding, "Due to the nature of online products designed to minimize premiums, there may be no or little surrender value upon mid-term cancellation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.