[Asia Economy Reporter Oh Ju-yeon] The domestic stock market, which had plunged to the 1400 level due to the novel coronavirus infection (COVID-19), has jumped to the 1700 level. In the securities industry, a positive view is gradually emerging that individual investors, who alone supported the index amid consecutive market crashes, might ultimately become the final winners.

According to the Korea Exchange on the 28th, the KOSPI fell to 1457.64 on the 19th but successfully rebounded, rising more than 15% within a week from the 23rd to the 27th, settling at the 1700 level. The market is optimistic that there will be no panic in the stock market like the previous crash, thanks to stronger stimulus policies than those during the 2008 financial crisis.

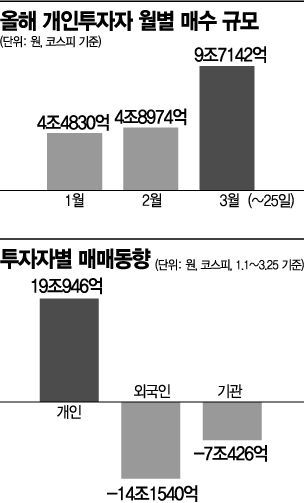

Although a short-term recession is inevitable, the market has become more sensitive to the positive view that recovery is possible once COVID-19 is controlled. Even if the index falls further in the future, more than 40 trillion won in funds waiting to enter the stock market are instead waiting to 'buy at a low price.' In particular, the stocks most purchased by individuals are large-cap stocks including Samsung Electronics. If the stock market continues to rise, it could mark a turning point to overcome the accumulated trauma of 'stocks falling when individuals buy,' distrust in indirect investment institutions, and the exclusion of individuals from large-cap KOSPI stocks.

According to the Korea Financial Investment Association, funds aiming to invest in stocks view the stock market crash caused by COVID-19 as an 'opportunity' and are increasing by about 1 trillion won daily. This is due to the spreading perception that 'it is still a low price in the long run.' As of the 25th, investor deposits reached a record high of 41.44 trillion won. This is a 34.94% increase compared to 30.71 trillion won on February 25, a month earlier.

Investor deposits refer to funds that investors have left in securities accounts after selling stocks or have deposited to buy stocks, classified as funds waiting to purchase stocks in the future. Until early December last year, these funds were maintained at around 23 to 24 trillion won. With growing expectations for the domestic stock market this year and the stock price rising above 2000, the amount increased to the 30 trillion won level. Usually, when the stock market falls, investor deposits also decrease. In August last year, when the KOSPI fell from 2000 to an intraday low of 1891.81, deposits decreased from 24 trillion won to 23 trillion won.

However, this time is different. Despite the stock market panic caused by COVID-19, with the KOSPI plunging to the 1400 level, more than 10 trillion won in funds have flowed in compared to early this year. Especially since mid-month, investor deposits have been increasing by trillions daily, which is noticeable.

Investor deposits, which were 32.9 trillion won on the 10th, rose sharply to 33.2 trillion won on the 11th, 34.08 trillion won on the 12th, and 36.19 trillion won on the 13th. This trend seems to be continuing. From 37.11 trillion won on the 18th, deposits surged daily by trillions to 38.36 trillion won on the 19th, 39.12 trillion won on the 20th, 39.87 trillion won on the 23rd, 40.99 trillion won on the 24th, and 41.44 trillion won on the 25th.

Every time the stock price falls, individuals absorb the volume, leading to jokes that it resembles the Donghak Peasant Movement. These funds are expected to continue supporting the stock market if prices decline further.

Kim Yong-gu, a researcher at Hana Financial Investment, said, "Individual investors have recently emerged as a market buffer against a series of foreign investor exoduses," adding, "Investor deposits, which can gauge the additional buying power of individual investors, have surged from about 28.5 trillion won at the end of last year to 41.4 trillion won recently, indicating that the remarkable momentum of individual investors in the domestic stock market is not yet over."

Kim analyzed, "From a mid- to long-term perspective, the unprecedented global systemic risk outbreak period has always been a buying opportunity, and the recent surge in household money movement due to the sharp cooling of the real estate market is a complex factor," adding, "This recent change cannot be dismissed as a temporary rebellion of retail investors." He further diagnosed, "Unless the COVID-19 impact directly leads to a catastrophic change in the global macro environment, the ultimate winner of this cycle will be individual investors, not foreigners. It is expected to be a historic turning point for the Korean capital market to overcome the avoidance of large-cap KOSPI stocks by individuals and households and distrust in indirect investment institutions such as active equity mutual funds."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)