[Asia Economy Reporter Kim Eunbyeol] An analysis has emerged that leveraged exchange-traded funds (ETFs) increase the volatility of domestic stock indices.

On the 27th, the Bank of Korea stated in its "Monthly Bulletin of Statistics" that "a significant transmission effect from shocks in the leveraged ETF market to the underlying asset markets (KOSPI 200 and KOSDAQ 150 index returns) was found," and "as the size of the leveraged ETF market grows, stock index volatility increases."

This result shows that when funds flow into the leveraged ETF market and asset size expands, changes in market conditions can amplify the effects on the stock market through arbitrage or daily rebalancing transactions with the underlying asset market.

Leveraged ETFs are funds designed to achieve a certain multiple of the underlying asset's returns (for example, twice the return of the KOSPI 200). While general ETFs replicate the composition of the index or products they track to achieve the same returns as the underlying assets, leveraged ETFs include futures or derivatives in their baskets in addition to the underlying asset components to expand exposure to the stock market and pursue target returns.

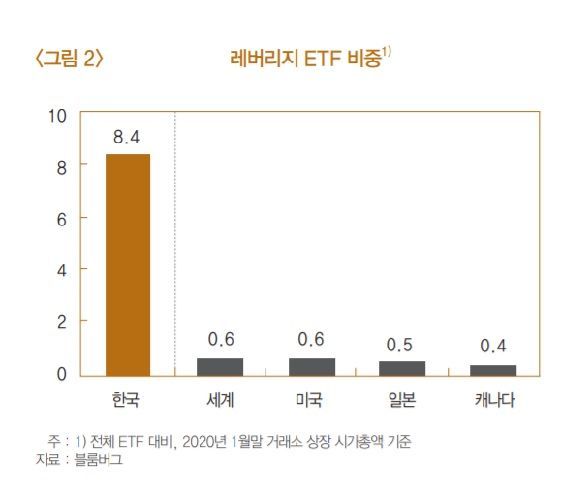

Since 2017, leveraged ETFs have shown rapid growth, increasing their share in the overall ETF market. By type, they are concentrated in equity products. Although leveraged ETFs have smaller asset sizes compared to general ETFs, they exhibit high turnover rates, and market liquidity conditions are generally favorable due to the operation of liquidity provider (LP) systems.

A Bank of Korea official explained, "The growth of leveraged ETFs has positively contributed to financial markets through liquidity provision, but concerns have been raised, especially in major countries like the U.S., that these funds may increase volatility in the underlying asset markets they track, prompting this investigation."

The Bank of Korea empirically analyzed the impact of leveraged ETFs on domestic stock index volatility from January 2013 to the end of last year using the EGARCH model and ordinary least squares (OLS) model.

The official added, "As leveraged ETFs are expected to continue steady growth based on advantages such as trading convenience, it is necessary to continuously monitor their impact on the volatility of underlying asset markets like the stock market."

They also stated, "It is necessary to make various policy efforts to ensure the healthy growth of leveraged ETFs, such as developing diverse financial products to reduce the concentration of leveraged ETFs in specific markets."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)