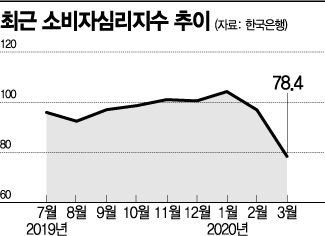

Bank of Korea 'March Consumer Sentiment Survey'

Consumer Sentiment Declines More Than Right After Financial Crisis

[Asia Economy Reporter Kim Eun-byeol] Consumer sentiment froze sharply in March due to the impact of the novel coronavirus infection (COVID-19). The shock reached the worst level, surpassing even the 2008 financial crisis. It recorded the largest monthly decline since the Bank of Korea began compiling monthly statistics in July 2008. The pandemic of COVID-19 significantly worsened both economic-related indices and household financial condition indices.

According to the 'March Consumer Sentiment Survey Results' announced by the Bank of Korea on the 27th, the Consumer Confidence Index (CCSI) for this month was 78.4, down 18.5 points from the previous month. This is the lowest level since March 2009 (72.8), during the height of the global financial crisis. The monthly decline was the largest since statistics began in July 2008. The CCSI is based on 100; a value above 100 indicates consumer sentiment is more optimistic than the long-term average (2003?2019), while below 100 indicates pessimism.

Previously, the largest drop was a 12.7-point fall in October 2008, immediately after the Lehman Brothers bankruptcy (September 2008). This means the impact of COVID-19 on consumer sentiment was greater than that of the global financial crisis. The monthly decline was also larger than in March 2011 (-11.1 points), when the Great East Japan Earthquake and Fukushima nuclear accident occurred, June 2015 during MERS, and February this year (-7.3 points) when COVID-19 first emerged.

In 2008, after the sharp drop in October, the CCSI fell an additional 10.2 points over the next two months. During MERS in 2015, after a 7.3-point drop in June, the index began to rebound from July, continuing an upward trend until November. COVID-19 is currently showing a sharp decline for the second consecutive month following last month. A Bank of Korea official explained, "During the financial crisis, after the 12.7-point drop in October 2008, it took until April 2009, six months later, to recover to the pre-crisis level (90.6 in September 2008)."

As COVID-19 spread domestically, consumer sentiment contracted first, and as it spread globally, financial markets also became unstable. Not only did the detailed components of the index fall sharply, but outlooks on employment opportunities, wages, inflation rate, and interest rate levels deteriorated across the board.

The Consumer Spending Outlook CSI and Household Income Outlook CSI fell by 13 points and 10 points respectively, recording 93 and 87. The economic condition sentiment also darkened. The Current Economic Situation CSI, which reflects how consumers view the current economic situation, dropped 28 points to 38, and the Future Economic Outlook Index fell 14 points to 62. Consumers perceive that COVID-19 will cause significant damage to the economy. The Current Living Conditions Index fell 8 points to 83, and the Living Conditions Outlook Index dropped 10 points to 83, indicating worsened perceptions of household financial conditions. The Employment Opportunity Outlook Index fell 17 points to 64, marking the lowest level since March 2009. The Interest Rate Level Outlook fell 20 points, the lowest since July 2008. The Wage Level Outlook also dropped 7 points, the lowest since July 2008.

The expected inflation rate, which indicates consumer price inflation expectations for the next year, was 1.7%, matching the previous month's record low. Consumers' perception of how much prices have risen over the past year, the inflation perception, remained at 1.8%, the same as one month ago.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.