The Impact and Side Effects of 'Korean-style Quantitative Easing'

[Asia Economy Reporters Eunbyeol Kim, Sehee Jang] '0% Base Interest Rate and Unlimited Liquidity Supply'

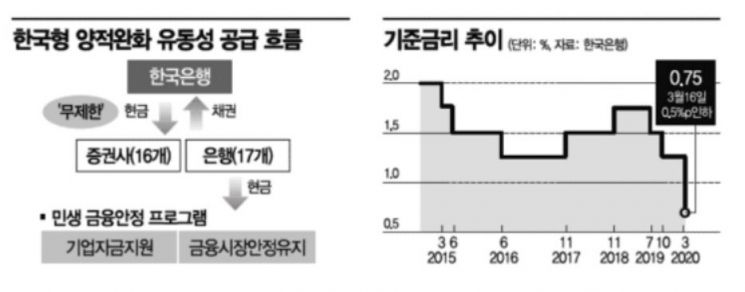

The Bank of Korea is stepping onto an unprecedented path, drawing attention to both its effects and side effects. On the 26th, the Bank of Korea decided to supply unlimited liquidity to the financial sector for three months, and ten days earlier, it sharply cut the base interest rate to 0.75%. Although these are extraordinary measures to mitigate the combined real and financial shocks caused by the novel coronavirus disease (COVID-19), evaluations vary since these policies have never been used before. Experts agree that a base interest rate in the 0% range and Korean-style quantitative easing could cause aftereffects. However, for now, they concur that these were unavoidable measures to minimize economic damage.

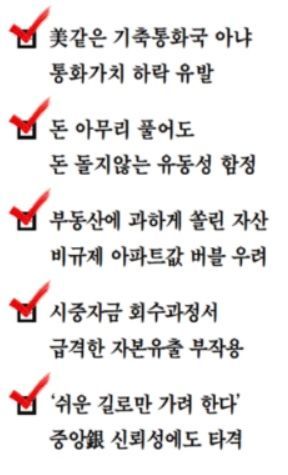

① Exchange Rate Increase = Quantitative easing in countries that are not key currency issuers generally causes a depreciation of the currency (exchange rate increase). In the case of the United States, even with quantitative easing, dollars spread worldwide, so side effects are limited. However, in countries like Korea, most of the currency remains domestic, leading to a decline in currency value. Nevertheless, the background for the Bank of Korea's aggressive monetary easing was the Korea-US currency swap agreement signed with the US Federal Reserve (Fed) on the 19th. Having secured the first dollar safety net, the Bank judged that concerns about exchange rate increases were not significant. If the exchange rate surges, creating favorable conditions for exports, the US Treasury might raise issues of currency manipulation, but since the whole world is pumping money in this 'emergency situation,' Korea is relatively free from this problem for the time being.

② Inflation = There are concerns that a sharp drop in currency value could eventually lead to inflation. In particular, similar to Japan, lowering interest rates to zero and pumping money endlessly might lead to a so-called 'liquidity trap,' where money does not circulate. However, fortunately, the current concern is recession caused by low inflation, so inflation-related side effects are a future issue. Some voices even suggest that technical deflation should be feared more than inflation. Professor Donghyun Ahn of Seoul National University’s Department of Economics stated, "Since everyone is trying to hold onto cash, there could actually be technical deflation."

③ Real Estate Bubble = Korea’s asset market, excessively concentrated on real estate, is also problematic. After the COVID-19 crisis ends, apartment prices under 900 million won, which are not subject to government regulations, may fluctuate. As the bubble grows, financial sector insolvency also increases. Financial authorities are considering deregulation if financial institutions’ profits deteriorate, but that does not mean financial sector insolvency will disappear. A Bank of Korea official said, "The fact that excessive debt accumulation could lead to a financial crisis after the COVID-19 situation ends is indeed a fearful aspect."

④ Rapid Capital Outflow = Another side effect is the significant shock to financial markets during the process of withdrawing the funds that were injected into the market. After the financial crisis, when former Fed Chairman Ben Bernanke announced in 2013 that fiscal spending would be reduced, emerging markets experienced a 'triple decline' in currency value, bonds, and stocks. It is easy to understand by imagining filling a boat with water from multiple directions and then draining the water later. Similarly, money was pumped to inflate asset prices, but when one side (developed countries) starts withdrawing funds, money in the other side (emerging markets) flows out, shaking the markets.

⑤ Central Bank Credibility Damage = There is also the criticism that 'central banks are trying to take the easy way out.' During the Vietnam War (1960?1975), the Fed printed dollars, accelerating inflation, and the process of resolving this issue led to the development of the global central banking system. If the central banking system collapses, trust can be broken. Professor Ahn added, "Ultimately, a strategy that directly addresses places where liquidity is blocked is necessary," and "this is why consideration of quantitative and qualitative easing (QQE) is also needed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.