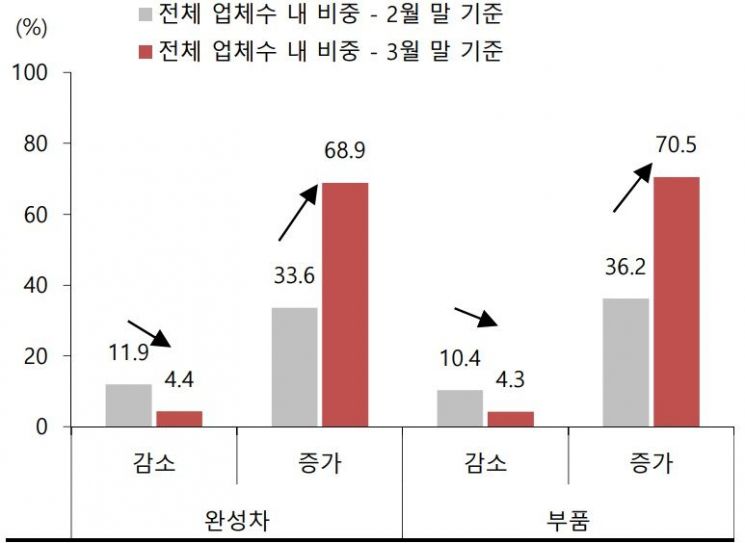

[Asia Economy Reporter Suyeon Woo] As the shock of the novel coronavirus infection (COVID-19) has materialized in production disruptions and demand contraction, the risk of bankruptcy is increasing across the global automotive industry. The proportion of companies with increased bankruptcy risk compared to the beginning of the year surged from the 30% range last month to 70% this month, indicating that the risk is spreading comprehensively.

According to Bloomberg and SK Securities on the 26th, as of March this year, the proportion of companies in the global automotive industry with increased bankruptcy risk compared to the beginning of the year was 68.9% for automakers and 70.5% for parts suppliers. Until February, this proportion was in the 30% range (33.6% for automakers, 36.2% for parts suppliers), so it increased by more than 30 percentage points in just one month.

This figure is based on Bloomberg's own criteria investigating changes in corporate bond ratings according to individual companies' financial items, stock prices, and credit ratings. Generally, if the one-year default rate is below 1%, it is classified as investment grade; between 1% and less than 10%, it is high yield; and 10% or more is classified as distressed grade.

By rating, the proportion of companies classified as high yield increased from 27.5% in February to 39.1% in March (from 246 to 351 companies), and the proportion of distressed grade companies also rose from 2.5% to 3.3% (from 22 to 30 companies). Conversely, the proportion of companies with strong investment grade ratings decreased from 70% to 56.1% (from 626 to 517 companies).

The proportion of companies with increased default risk rose from the 30% range to the 70% range / Data = Bloomberg, SK Securities

The proportion of companies with increased default risk rose from the 30% range to the 70% range / Data = Bloomberg, SK Securities

By region, the proportion of high yield companies was high among automakers and parts manufacturers with factories in China, Korea, and Japan. However, when looking at the increase rate of high yield companies relative to the number of companies in each country, Latin America and Western Europe reached 90%, while China showed 46%, which is lower than the industry average. In other words, while the absolute number of companies indicates higher risk in Asian regions such as China, when divided by country, issues among European or North American companies are more prominently highlighted.

Recently, as COVID-19 has spread worldwide, global automotive factories have been shutting down one after another. Not only are there parts procurement issues, but companies are also suffering from shutdown fears due to infections occurring at workplaces, and a decrease in overseas market demand is inevitable.

Researcher Sunwoo Kwon of SK Securities said, "As the spread speed varies by region, the volatility of bankruptcy risk will further increase," adding, "It is necessary to continuously monitor the impact on parts suppliers by considering the production status and sales of major companies by region."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)