[Asia Economy Reporter Ki-min Lee] A survey conducted by the Federation of Korean Industries (FKI) revealed that the majority of experts in the fields of law and economics oppose the National Pension Service's (NPS) involvement in corporate management.

On the 26th, the FKI announced that out of 43 experts surveyed, 90.7% (39 experts) opposed the NPS's intervention in corporate management. Only 7% (3 experts) supported the NPS's involvement. Recently, the system was revised to allow the NPS easier access to corporate management through amendments to the Enforcement Decree of the Capital Market Act and the establishment of guidelines for the NPS's active shareholder activities.

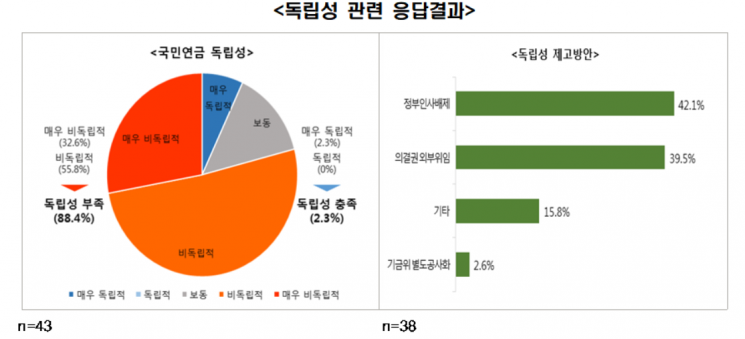

According to the survey, 88.4% (38 experts) responded that the independence of the NPS fund management is insufficient. In contrast, only 2.3% (1 expert) considered it independent.

Regarding measures to enhance the independence of fund management, the highest response was that government officials should be excluded at 42.1% (16 experts). This was followed by delegation of voting rights to external parties at 39.5% (15 experts), others at 15.8% (6 experts)*, and separate corporatization of the Fund Management Committee at 2.6% (1 expert).

Concerning the strong opinion that government officials should be excluded to enhance independence, the FKI pointed out that the Fund Management Committee includes eight members who can be seen as government representatives (five ministers and vice ministers, the NPS CEO, and two heads of government-funded research institutes), indicating a governance structure vulnerable to government influence, which raises serious concerns.

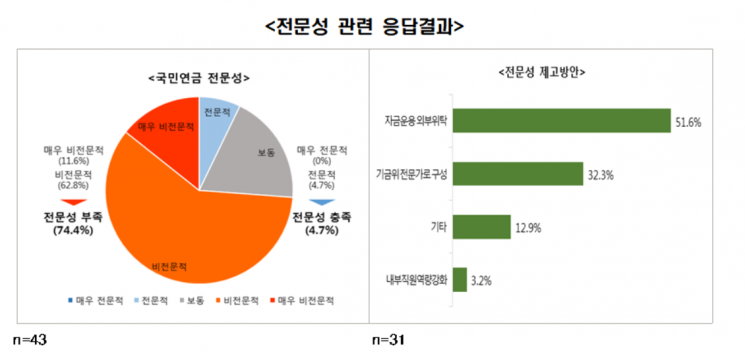

Regarding the lack of expertise in the NPS fund management, 74.4% (32 experts) expressed this view. Conversely, only 4.7% (2 experts) believed there was sufficient expertise, according to the FKI.

As for measures to secure expertise, 51.6% (16 experts) suggested outsourcing fund management, 32.3% (10 experts) recommended composing the Fund Management Committee with experts, 12.9% (4 experts) chose other options, and 3.2% (1 expert) favored strengthening internal capabilities.

Yoo Hwan-ik, Director of Corporate Policy at the FKI, stated, “The results of this expert survey show that experts believe it is undesirable for the NPS, which lacks independence and expertise, to intervene in corporate management. The NPS should focus on its fundamental role of securing the retirement security of the public rather than interfering in corporate management.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.