Delays in Product Revisions Due to COVID-19

Concerns Over Larger Cuts in Scheduled Interest Rates

[Asia Economy Reporter Oh Hyung-gil] Some insurance companies are postponing the scheduled premium hikes next month to the end of the first half of the year. This is due to disruptions in product revisions caused by the novel coronavirus disease (COVID-19).

Consumers who were planning to newly subscribe to insurance now have more time to join products at the previous premium rates. The pre-increase marketing, which usually takes place in March before premium hikes, has also been affected by COVID-19.

According to the insurance industry on the 25th, the application timing for insurance product revisions, originally scheduled for next month, has been delayed by two months to June. This follows the financial authorities' acceptance of the industry's request to postpone product revisions.

The Financial Services Commission decided on a non-action opinion at the regular meeting held on the 18th, on the condition that product revisions and the reduction of the assumed interest rate be applied simultaneously. This means that even if product revisions are not completed by the end of this month, no regulatory actions will be taken under supervisory regulations.

Insurance companies are experiencing difficulties in product revision work due to COVID-19. Small and medium-sized insurers, in particular, are more affected due to manpower shortages. The implementation of remote work for employees to prevent infection spread and regional dispersed work arrangements have made normal work operations difficult.

By postponing product revisions, there is also an intention to utilize the delay in lowering the assumed interest rate, which is considered a factor in premium increases, for business purposes.

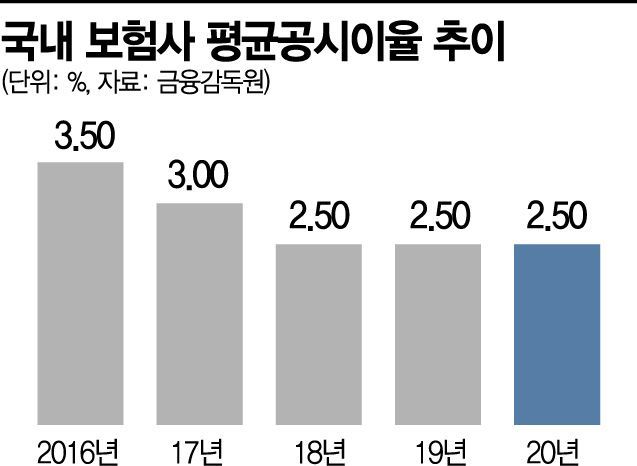

The assumed interest rate refers to the expected rate of return that an insurer can earn through investment operations on the premiums received from customers until insurance benefits are paid. Insurers set the assumed interest rate to design products and calculate the premiums customers must pay; a higher assumed interest rate results in lower premiums, while a lower assumed interest rate leads to higher premiums.

However, large insurers plan to adjust the assumed interest rate regardless of the postponement of product revision application timing. Large companies have been adjusting the assumed interest rate since the beginning of the year. Samsung Life Insurance has applied the revised assumed interest rate to some products since early this year and plans to lower the assumed interest rate for whole life insurance by 0.25 percentage points starting in April. Hanwha Life Insurance is also reviewing a reduction in the assumed interest rate in April.

Additionally, concerns have been raised that the extent of the assumed interest rate reduction may increase due to the postponement of the timing. This reduction is expected to reflect the impact of the Bank of Korea's recent 'big cut' (a 0.50 percentage point base rate cut). If the assumed interest rate drops by 0.5 percentage points, premiums are expected to increase by about 10-15%, which will directly translate into a burden on consumers.

A life insurance industry official said, "Currently, the government bond yields are preemptively reflecting the market's expectations of interest rate cuts, so the assumed interest rate will fall to its lowest level of the year," adding, "Raising premiums to a level that consumers can feel is a difficult decision for insurers as well, so a tense game of nerves may ensue."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.