Holding Company WM Executive Holds Concurrent Positions in Bank and Securities

Collaboration Emphasized Only During Product Sales

Fails to Perform Risk and Internal Control Functions

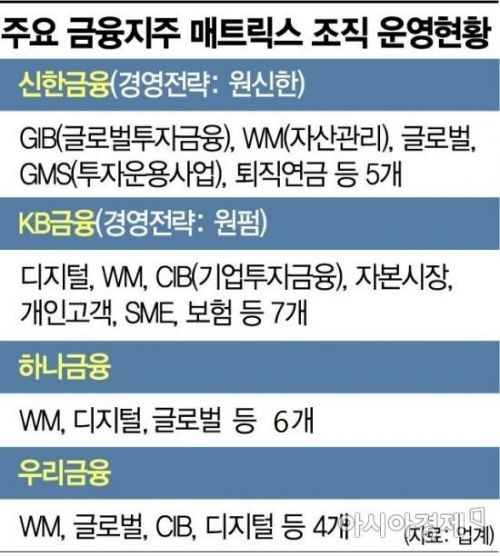

[Asia Economy Reporter Kwon Haeyoung] The matrix system of major domestic financial holding companies is being pointed out as the cause of recent consecutive financial investment product loss incidents, such as overseas interest rate and real estate-linked derivative-linked securities (DLS) and Lime Asset Management funds. The matrix organization, which emphasizes collaboration among affiliates led by the holding company, is criticized for having holes in the matrix system as it operates actively only during product sales but fails to function properly in risk management and internal control.

According to the financial sector on the 23rd, the four major financial holding companies?Shinhan, KB, Hana, and Woori Financial?have all introduced a matrix system in their wealth management (WM) divisions. A holding company WM executive concurrently serves as a bank and securities WM executive, overseeing all functions.

The matrix organization refers to grouping businesses that were separately operated by each affiliate into units integrated and managed by the holding company. This is to strengthen collaboration among affiliates and drive initiatives at the holding company level. The trend is expanding into investment banking (IB), retirement pensions, global, and digital sectors, with all major holding companies showing prominent matrix functions in the WM division.

A financial sector official said, "Looking at the recent financial investment product loss incidents, a characteristic is that bank customers heavily invested in risky products mainly sold by securities firms," adding, "While the holding company actively drove sales promotion, it failed to play a role in risk management and internal control, so the holding company’s responsibility needs to be thoroughly examined."

A representative example is the German Heritage DLS, which Shinhan Financial Group sold massively, causing losses to investors. This product, investing in German cultural heritage development projects, was mainly sold at Shinhan PWM Centers, which are combined bank and securities branches. Although Shinhan Financial Investment was the seller, internal data shows that Shinhan Bank customers invested 211.1 billion KRW (637 people), more than the 169.1 billion KRW (886 people) invested by Shinhan Financial Investment customers. This was because bank private bankers (PBs) connected customers to securities PBs for sales. According to financial sector sources, this trend is becoming more prominent as other financial groups strengthen their matrix functions.

On the other hand, risk management at the financial group level is not properly conducted. Shinhan Financial Investment is understood to have recognized the insolvency of Lime Asset Management funds in June last year but continued to sell the funds afterward, and Shinhan Bank also sold Lime Asset Management funds until August of the same year, causing losses to investors.

Some argue that holding companies should strengthen matrix functions not only in product sales but also in risk management and internal control. After suffering investor losses from the bank’s sale of derivative-linked funds (DLF) last year, Woori Financial Holding recently established an Internal Control Management Committee within its board of directors.

A financial sector official said, "While it is necessary to enhance synergies among affiliates such as banks, securities, and insurance at the holding company level to raise the group’s capabilities, it is also urgent to establish a system that can strengthen risk management and internal control across the entire group," adding, "Financial authorities also need to inspect risks at the financial group level, not just individual banks or securities firms, and order comprehensive risk management reinforcement."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.