Difficulty in Hiring Chinese Technicians

High Dependence on China for Key Materials Like Plywood and Marble Causes Supply Disruptions

Serious Concerns Over Project Delays

Middle East Orders Reach $5.7 Billion This Month, 10 Times Last Year’s Figure

Good Performance but Concerns Grow Due to Global Economic Downturn and Oil Price Plunge Leading to Sharp Decline in New Orders

[Asia Economy Reporter Donghyun Choi] The construction industry is facing a double burden both domestically and internationally due to the economic downturn caused by the spread of the novel coronavirus disease (COVID-19) combined with the plunge in oil prices. The housing sector, which has been the industry's mainstay, is experiencing shortages of materials and labor, and even the Middle East orders that showed a sharp recovery earlier this year are at risk of being halted.

◆ Shortage of labor and materials... Concerns over project delays = According to the industry on the 23rd, concerns about construction delays due to the impact of COVID-19 have recently increased at domestic construction sites. In the case of Construction Company A, they are preparing countermeasures fearing that if there are disruptions in labor and material supply, design changes will become inevitable. Construction Company B is investigating the supply status of materials with a high proportion of Chinese origin and the number of foreign workers at each site to prepare for any unforeseen incidents.

Due to the nature of the construction industry, if the project duration is extended, costs increase exponentially. This is why each site fights desperately to meet the project schedule. A representative from a construction company said, "Due to the recent impact of COVID-19, it is difficult to find Chinese technicians who accounted for half of the foreign workforce at the sites, and the supply chain for materials highly dependent on China, such as plywood and marble, is also shaking," adding, "Although there has been no direct action from clients yet, if issues like project delays become serious, conflicts may arise."

The Korea Construction Association, a gathering of construction companies, has also started preparing countermeasures. The association recently launched a reporting center to receive complaints related to difficulties caused by COVID-19. An association official said, "So far, there have been no reports from the field regarding compensation for project delays or contract period issues, but we are monitoring the situation closely," and added, "We plan to actively submit various opinions to government ministries such as the Ministry of Land, Infrastructure and Transport."

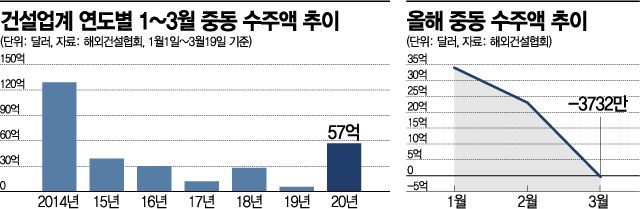

◆ Dark clouds over the Middle East market again = Overseas orders are also showing rising concerns, centered on the Middle East market. According to the Overseas Construction Association, as of the 19th of this year, domestic construction companies' orders from the Middle East amounted to $5.7 billion (7.35 trillion KRW), more than ten times the $560 million recorded in the same period last year. It is the first time in six years since 2014 ($12.9 billion) that Middle East orders have exceeded the $5 billion mark during the same period. This atmosphere had raised expectations that the Middle East market, once considered a stronghold for construction companies, might be recovering from a long recession.

However, concerns over a global economic downturn and the plunge in oil prices are increasing the likelihood that these hopes may be dashed. On the 18th (local time), West Texas Intermediate (WTI) crude oil plunged to $20.37 per barrel at the New York Mercantile Exchange. This is the lowest level in about 18 years since February 2002. The international oil price falling to the $20 range shows a worse situation than during 2015-2016 when orders from the Middle East market sharply declined. Although it rebounded to the mid-$20 range the following day due to technical factors, the volatile market itself may heighten uncertainty.

In fact, while Middle East orders amounted to $5.75 billion in January and February, there was a loss of $37 million in orders as of the 20th of March. It appears that contract amounts were reduced for specific reasons in countries such as Saudi Arabia and Iraq. By project type, losses occurred in services (-$198.23 million), water supply (-$24.61 million), power plants (-$9.09 million), and oil facilities (-$1.78 million).

The Overseas Construction Association has also recently launched reporting centers divided by regions such as Asia, Africa & Middle East, and Americas & Europe. Kim Jong-guk, Director of External Cooperation at the Overseas Construction Association, said, "There have been no reports of project cancellations in the Middle East yet, but if the COVID-19 situation prolongs, there may be problems with bidding and other processes."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.