KOSPI PBR at 0.64x... Lowest Since 2000

12-Month Forward PBR at 0.58x... 74% of Companies Below 1x

Brokerage Firms Say "Excessive Undervaluation" VS "Bottom Still Far Away"

[Asia Economy Reporter Minwoo Lee] Due to the impact of the novel coronavirus infection (COVID-19), the stock market has declined, causing the KOSPI stock price level to fall below its liquidation value. This is the lowest level since 2000.

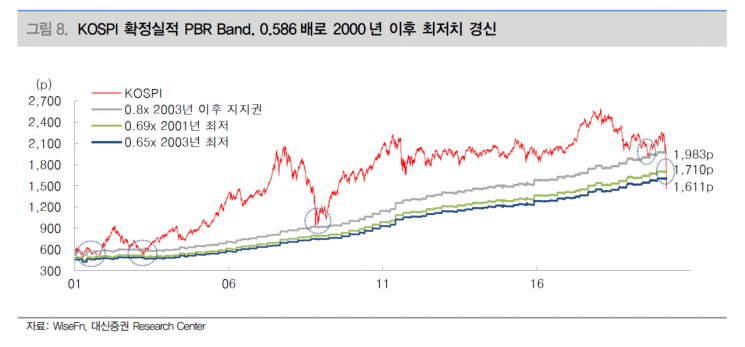

According to the Korea Exchange on the 23rd, the price-to-book ratio (PBR) of the KOSPI based on confirmed earnings as of the 20th was recorded at 0.64 times. On the 19th, when the KOSPI dropped to the 1450 level, it even fell to 0.586 times.

The KOSPI PBR is the ratio of the total market capitalization divided by the total capital. If it is below 1, it means that the market capitalization is less than the book value of net assets (liquidation value). Lee Kyung-min, a researcher at Daishin Securities, explained, "A confirmed earnings-based KOSPI PBR of 0.586 times is the lowest since 2000," adding, "0.65 times was the lowest record in 2003."

The 12-month forward PBR, which can gauge the future KOSPI stock price level, is also hovering near the bottom. According to financial information provider FnGuide, the KOSPI 12-month forward PBR, calculated based on the expected net asset value 12 months ahead, was 0.58 times.

Among all industries, 86.4% (19 sectors) had a 12-month forward PBR below 1. The electric and gas industry was the lowest at 0.16 times, followed by banks (0.17), insurance (0.22 times), steel and metals (0.26 times), securities (0.36 times), and distribution (0.49 times). Among companies with earnings estimates from three or more securities firms, 141 out of 190 companies (74.2%) had a 12-month forward PBR below 1.

Accordingly, there are also opinions in the securities industry that the current KOSPI stock price is excessively low. Lee Kyung-soo, head of the research center at Meritz Investment & Securities, said, "The securities industry initially expected corporate net profits to reach 130 trillion won based on a 2% growth rate this year," adding, "Even if the growth rate is lowered to 1%, the estimate is around 60 to 70 trillion won, and when corporate net profits were at this level in the past, the KOSPI index was around 1500 to 1600." He continued, "Considering that during the 2008 financial crisis, actual net profits were about 50% of securities industry estimates, whether viewed by growth rate or the gap between earnings estimates, levels below 1500 are considered undervalued."

Jo Seung-bin, a researcher at Daishin Securities, said, "The reason the current KOSPI PBR is below 1 is that the KOSPI's return on equity (ROE) is falling short of the cost of equity (COE)," and predicted, "If the economy recovers and earnings improve, causing the KOSPI PBR to rise to around 1, the KOSPI index could reach the 2500 level."

However, there are also concerns about the possibility of further declines due to the increasing number of COVID-19 cases and variables such as the sharp drop in oil prices. Na Jung-hwan, a researcher at DS Investment & Securities, warned, "COVID-19 cases are still rapidly increasing in Europe, making it difficult for foreign investors' net selling to subside. Moreover, if U.S. economic indicators reflecting COVID-19, such as the manufacturing Purchasing Managers' Index (PMI), worsen more severely than expected, the stock market could plunge significantly," adding, "If the COVID-19 situation develops into a full-scale recession, the KOSPI index could fall to the 1200 level."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)