[Asia Economy Reporter Kim Hyung-min] Major European stock markets continued to decline on the 18th (local time). This is analyzed to be due to growing concerns that corporate earnings deterioration is inevitable amid the spread of the novel coronavirus infection (COVID-19).

As of 11:30 a.m. (Greenwich Mean Time, GMT) that day, the FTSE 100 index of the London Stock Exchange in the UK was trading at 5,035.30, down 4.90% from the previous trading day's closing price. If the London Stock Exchange closes lower again that day, it would mean the index has fallen on 8 out of the last 10 days.

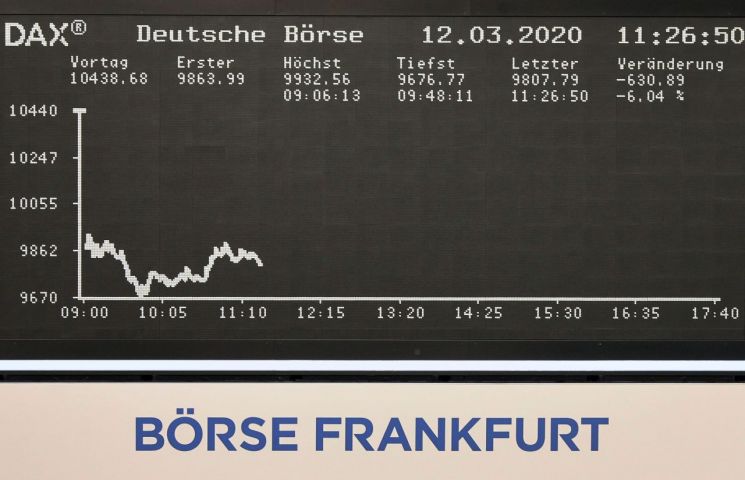

The DAX index of the Frankfurt Stock Exchange in Germany was down 5.39% at 8,457.25, and the CAC 40 index of the Paris Stock Exchange in France was trading down 5.57% at 3,767.36.

Major European stock markets had closed slightly higher the previous day due to economic stimulus measures from various countries. However, concerns over corporate earnings deterioration and the resulting economic recession due to the impact of COVID-19 have not disappeared and are growing, leading to a sharp decline again that day.

As travel demand decreases due to COVID-19, global airlines are expected to suffer serious damage. Related companies also seem unlikely to avoid the shock. On the London Stock Exchange, Meggit, which supplies aircraft parts to Boeing, was trading down 19.73%, and Rolls-Royce, an aircraft engine manufacturer, was down 13.36%.

As UK Prime Minister Boris Johnson strengthened 'social distancing' measures by urging people to refrain from using pubs, clubs, and cinemas, companies in these sectors are also expected to face difficulties for the time being.

On the other hand, with increased stockpiling due to COVID-19, the shares of large retailers such as Sainsbury's on the London Stock Exchange rose by around 10%, and shares of food and hygiene product companies showed an upward trend.

UK Chancellor of the Exchequer Rishi Sunak announced plans to promote government-guaranteed loans worth ?330 billion (approximately 496 trillion won), equivalent to 15% of the UK's gross domestic product (GDP), to support companies and others.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)