[Asia Economy Reporter Naju-seok] An analysis has emerged that U.S. shale companies are being pushed into a crisis due to the oil price war among oil-producing countries. For shale companies with high extraction costs, there are only a few that can withstand low oil prices.

According to an analysis by Rystad Energy, an oil market consulting firm, on the 15th (local time), only 16 U.S. shale companies can manage at $35 per barrel.

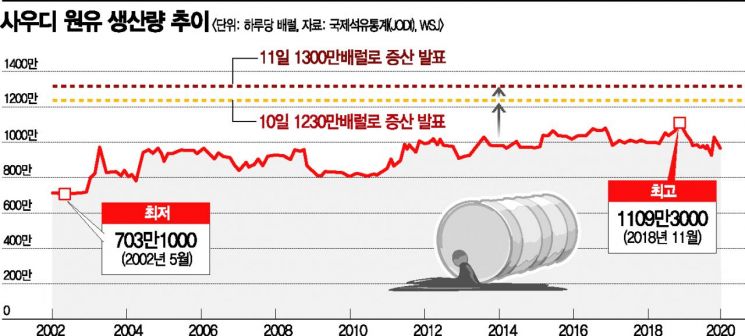

At the beginning of this year, oil prices traded around $60 per barrel, but they have plummeted due to the outbreak of the novel coronavirus (COVID-19) and the production increase decision between Saudi Arabia and Russia. West Texas Intermediate (WTI) crude oil is currently trading around $30 per barrel.

Moreover, the extraction cost of shale gas excludes dividends and company expenses as a business, so for shale companies to maintain profitability, the oil price per barrel must exceed $35. In fact, this means that most shale companies are operating at a loss.

Most U.S. shale companies had predicted oil prices between $55 and $65 per barrel. However, as oil prices continue to fall recently, shale companies are focusing on restructuring and cost reduction.

Initially, when Saudi Arabia proposed a production cut of 1.5 million barrels per day due to decreased demand from COVID-19, Russia opposed the move, citing the need to observe market conditions further. Experts analyzing Russia's decision, which directly ignited the oil price war, suggest that Russia targeted the U.S. shale industry. They argue that Russia deliberately allowed low oil prices to persist to eliminate the unprofitable shale industry.

Low oil prices are expected to impact not only currently operating shale companies but also new extraction projects.

Artem Avnamov, head of research at Rystad Energy, said, "Most shale companies will be at risk if current oil prices persist," adding, "New extraction projects are expected to be quickly put on hold."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.