DramExchange "Possibility of Slower Performance Than Expected, NAND Price Decline Reversal from Q3"

Hana Financial Investment Lowers Q3-Q4 DRAM Price Increase Estimates... Samsung Electronics and SK Hynix Earnings Outlook Also Reduced

Hyundai Kia Motors Faces 'Production to Sales Cliff' Spread from China to US and Europe

[Asia Economy Reporters Kim Hyewon and Lee Changhwan] The new coronavirus infection (COVID-19) has struck the United States and Europe following China, abruptly halting the memory semiconductor industry's anticipated boom this year. Due to the COVID-19 aftermath, consumer sentiment has frozen solid, leading to a bleak forecast that shipments of electronic products such as smartphones, TVs, and PCs will contract this year. Consequently, following the direct hit to key industries like automobiles and refining/petrochemicals, even the semiconductor sector?the last bastion?is expected to inevitably suffer performance deterioration due to shrinking demand.

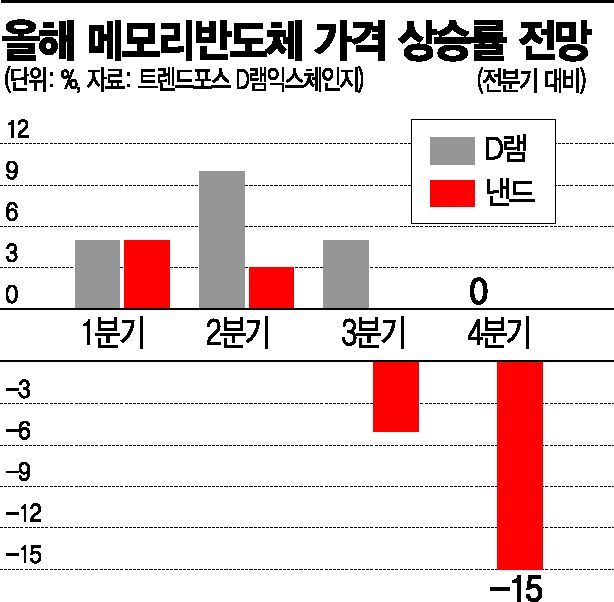

On the 16th, TrendForce DRAMeXchange, a semiconductor market research firm, projected that as COVID-19 spreads worldwide including the US and Europe, the memory semiconductor market for DRAM and NAND flash will decline faster than expected. Currently, with low product inventory levels, growth is expected to continue through the second quarter, but starting in the third quarter, the impact of sluggish electronic product sales will intensify, potentially causing semiconductor prices to turn downward.

In particular, it is anticipated that NAND flash prices will fall more sharply as smartphone and PC sales decline due to COVID-19. DRAMeXchange forecasts that NAND flash prices will drop by up to -5% in the third quarter compared to the previous quarter, and by -15% in the fourth quarter. DRAMeXchange explained, "With the global economy rapidly cooling and consumer sentiment shrinking due to COVID-19, demand for electronic products will continue to decrease," adding, "COVID-19 raises logistics and labor costs while lowering corporate profits, potentially accelerating industry-wide restructuring." Another market research firm, IC Insights, also expressed concern that "the semiconductor industry could fall into an L-shaped recession due to COVID-19."

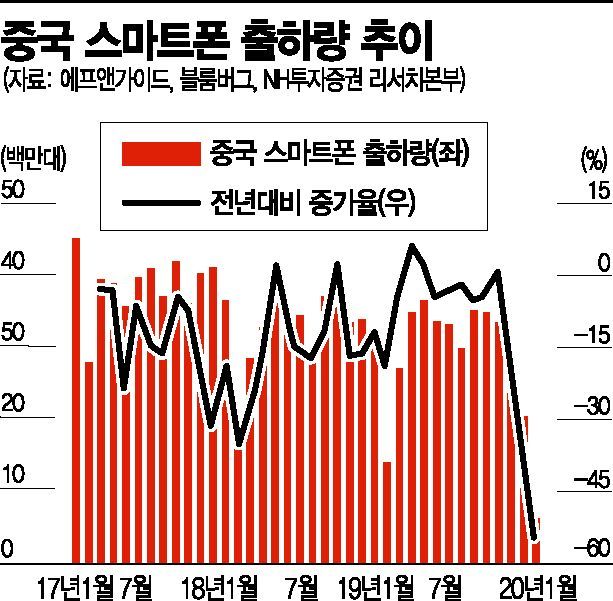

On the same day, Hana Financial Investment lowered its estimated DRAM price growth rates for the third and fourth quarters by 10% and 3%, respectively, compared to the previous quarter. The previous estimates were increases of 20% and 5%. This adjustment reflects the forecasted declines in PC and smartphone shipments by 9.0% and 4.9%, respectively, compared to the previous year. In fact, last month, smartphone shipments in China dropped 55% year-on-year to 6.34 million units, showing the impact of COVID-19.

Expectations for Samsung Electronics and SK Hynix have also been lowered. Hana Financial Investment reduced Samsung Electronics' IM division operating profit forecast from 2.8 trillion won to 2.2 trillion won for the first quarter, and from 10.6 trillion won to 9.5 trillion won annually, reflecting the slowdown in set demand in the front-end industry. For SK Hynix, operating profit forecasts for the third and fourth quarters were lowered by 700 billion won and 800 billion won, from 2.6 trillion won to 1.9 trillion won and from 3.1 trillion won to 2.3 trillion won, respectively.

Oh Taedong, Head of Investment Strategy at NH Investment & Securities, said, "Among sectors with good annual returns this year, the semiconductor and equipment sectors have been most affected by COVID-19," adding, "The concern lies in future smartphone sales; how much deferred demand recovers will determine the profit levels of domestic companies."

The strategy of Hyundai Kia Motors, which aimed to offset sluggish sales in China with sales in the US and Europe amid the COVID-19 crisis, has also turned red. While production disruptions initially hampered operations, now not only Hyundai Kia but the global automobile manufacturing industry faces a 'sales cliff' due to demand contraction. Fiat Chrysler temporarily closed four factories in Italy, and European suppliers delivering parts to Renault, Peugeot, and others are experiencing numerous shutdowns. If disruptions in US and European parts supply affect domestic factories, a second wave of chain shutdowns due to COVID-19 cannot be ruled out. US automakers GM and Ford have shifted to remote work with only essential personnel remaining on-site and have postponed new car launches, making normal operations impossible.

Voices are emerging calling for tax support measures to improve the business environment, which has adversely affected the entire domestic industry. Yoo Hwanik, Director of Corporate Policy at the Federation of Korean Industries, stated, "Since the World Trade Organization (WTO) declared the COVID-19 pandemic, global stock markets including Korea's have plummeted, and pandemic phenomena are appearing across the economy and industry," emphasizing, "Bold regulatory relaxation measures by industry and active support plans should be prepared to help industries in crisis overcome difficulties."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)