Life Insurance Association Promotes 'Insurance Fraud Out' Channel

Serious Organization of Fraud Crimes Involving Hospitals and Agents

Raising Awareness with Various Cases of Dosu Treatment and Alveolar Bone

[Asia Economy Reporter Oh Hyung-gil] "The insurance agent encouraged me to sign up for insurance by saying that I could receive insurance money just by being hospitalized. The agent said I only needed to be admitted to the hospital they designated. Is this insurance fraud?"

The Life Insurance Association recently rolled up its sleeves to promote its newly launched YouTube channel to insurance companies and related institutions. Their methods to increase subscribers are no different from typical YouTubers. They explain every step of how to subscribe in detail. Why did the association create a YouTube channel amid the flood of diverse content on YouTube?

The channel created by the Life Insurance Association is called "Insurance Fraud Out." It features web drama-style videos around 10 minutes long. As the name suggests, it depicts the Insurance Fraud Investigation Unit (SIU) task force investigating and uncovering insurance fraud. Videos for season 2 have already been uploaded.

Starring task force members, the videos clearly explain various cases occurring in the insurance field, from false and excessive treatment frauds such as cataracts, physical therapy, and alveolar bone, to fraud involving insurance agents and other insurance-related personnel. It also mentions that reporting insurance fraud can earn rewards.

An association official explained, "There are frequent cases where people get involved in insurance fraud just by trusting what hospitals or agents say," adding, "We created the YouTube channel to raise awareness through examples showing how actions done unknowingly can become insurance fraud."

The association's unusual move to launch a YouTube channel is a last-ditch effort to eradicate the ever-increasing insurance fraud.

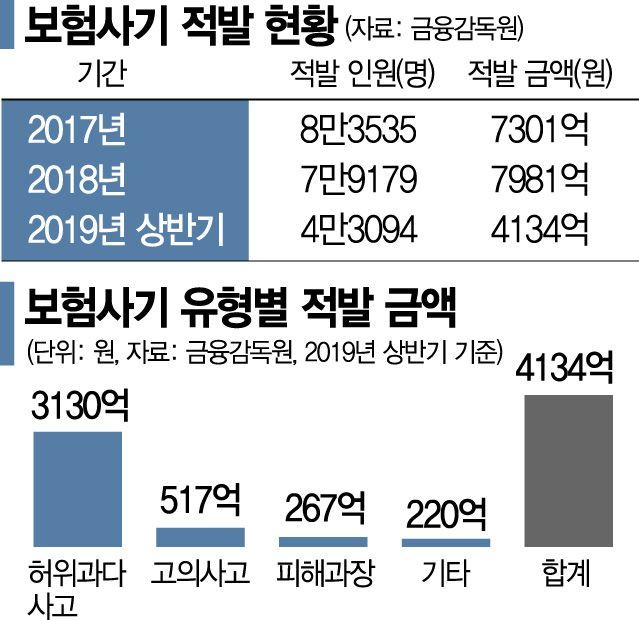

According to the Financial Supervisory Service, the amount detected for insurance fraud was 413.4 billion KRW in the first half of last year, an increase of 13.4 billion KRW from 400 billion KRW in the same period the previous year. In the first half of 2017, it was 370.3 billion KRW, showing a trend of increasing by hundreds of billions each year. The number of people caught for insurance fraud in the first half of last year was 43,094, up 11.4% compared to the previous year.

While hard frauds, such as intentionally causing injuries or self-harm, are decreasing, soft frauds that manipulate accident details or exaggerate damages are increasing. Insurance fraud methods are gradually becoming more sophisticated and cunning.

Not only doctors but also insurance agents and brokers are increasingly involved, showing signs of organization. Recently, platforms like YouTube, Instagram, and Facebook have been misused as tools for insurance fraud. Content that misleads viewers, such as how to claim more insurance money or how to negotiate insurance settlements well, is overflowing and encouraging insurance fraud.

According to the Special Act on the Prevention of Insurance Fraud, inflating damages or receiving insurance money with false medical certificates can result in imprisonment for up to 10 years or fines up to 50 million KRW. Last year, an obstetrician who committed medical insurance fraud amounting to 700 million KRW was sentenced to prison.

The insurance industry is so committed to reducing insurance fraud that it has developed detection systems applying big data and artificial intelligence (AI) technology. However, there are criticisms that industry efforts alone have limitations.

The industry is primarily demanding amendments to the Special Act on the Prevention of Insurance Fraud. They argue that public insurance-related institutions such as the National Health Insurance Service and the Health Insurance Review & Assessment Service, along with insurance companies, should establish a cooperative system to activate insurance fraud investigations and prepare recovery provisions.

An industry official emphasized, "We need to unify the procedures from reporting to reward payment to activate insurance fraud reporting," adding, "It is also necessary to strengthen reward payment criteria to encourage internal whistleblowers such as medical personnel and insurance agents to report."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)