Listed Companies' Earnings Downgrade Trend Likely to Accelerate by Month-End

Duty-Free Shops, Cosmetics, and Airlines Severely Hit... Recovery Timing Uncertain

[Asia Economy Reporter Song Hwajeong] Concerns are growing over the earnings of listed companies this year due to the spread of the novel coronavirus infection (COVID-19). While a contraction in the first quarter is inevitable, second-quarter earnings forecasts are also being revised downward.

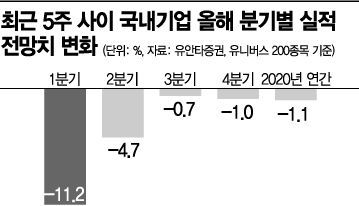

According to Yuanta Securities on the 9th, the operating profit forecast for the first quarter of the domestic stock market, based on Yuanta Securities Universe 200 stocks, has been revised downward by 11.2% over the past five weeks. The downward adjustment trend is expected to accelerate by the end of this month. Researcher Kim Kwanghyun of Yuanta Securities said, "The steep 11.2% downward revision is calculated based on the average forecast over the past month, so further downward adjustments seem inevitable over time," adding, "Especially since first-quarter earnings forecast reports are published around the end of the month, the speed of downward revisions may accelerate."

Second-quarter earnings forecasts have also been lowered. The operating profit forecast for the second quarter of Yuanta Securities Universe 200 stocks has decreased by 4.7% over the past five weeks. Researcher Kim explained, "Considering the recent downward adjustment trend, a contraction in first-quarter earnings is certain, and if COVID-19 prolongs, second-quarter earnings will also be affected," adding, "While the upward trend of the earnings cycle will be maintained, the timing of the positive turnaround in earnings growth rate will be delayed compared to the beginning of the year."

The earnings recovery of industries affected by COVID-19 is expected to be even slower. Researcher Park Jongdae of Hana Financial Investment said, "It is difficult to estimate how much the earnings of duty-free shops and cosmetics companies will decline in the first quarter," adding, "Even if the number of confirmed COVID-19 cases eases around mid-March, duty-free shop sales are expected to hit bottom in March, decrease by 30% year-on-year in April, and only turn positive in May, indicating a high possibility of earnings decline not only in the first quarter but also in the second quarter."

The airline industry is also facing a severe blow in the passenger sector. In February, the number of international passengers transported at nationwide airports was 3,989,000, down 46.6% compared to the same period last year. This is because, as of the 8th, a total of 103 countries have restricted entry from Korea due to the spread of COVID-19, cutting off passenger demand. Researcher Kim Yuhyuk of Hanwha Investment & Securities said, "The unprecedented entry restrictions have caused a demand shock greater than past events such as the 9/11 attacks (-10%), Severe Acute Respiratory Syndrome (SARS) (-39.6%), the financial crisis (-17.6%), and Middle East Respiratory Syndrome (MERS) (-15%)," adding, "March reservation rates are also estimated to have decreased by nearly 60%, so it will not be easy for the contracted demand to recover in the short term."

There are also observations that the progress of COVID-19 could affect earnings into the second half of the year. Researcher Kim Kwanghyun said, "The third quarter has been revised downward by 0.7% and the fourth quarter by 1.0%, but they remain at levels similar to the beginning of the year," adding, "This can be considered a result reflecting deferred sales and supplementary budget effects after the end of COVID-19, but it is difficult to accept the initial guidance as is under the current circumstances."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.