Due to the impact of the novel coronavirus disease (COVID-19), a temporary closure notice is posted at a store in Jung-gu, Seoul on the 4th. Photo by Hyunmin Kim kimhyun81@

Due to the impact of the novel coronavirus disease (COVID-19), a temporary closure notice is posted at a store in Jung-gu, Seoul on the 4th. Photo by Hyunmin Kim kimhyun81@

[Asia Economy Reporter Kwon Haeyoung] Regional banks, hit hard by the collapse of key industries, are suffering from a double burden due to the economic freeze caused by the novel coronavirus infection (COVID-19). With concerns rising over the surge of marginal companies and self-employed individuals amid the spread of COVID-19, the banking sector’s soundness management alarm has been triggered. In particular, regional banks, which are more vulnerable in terms of soundness compared to commercial banks, are expected to face a challenging year.

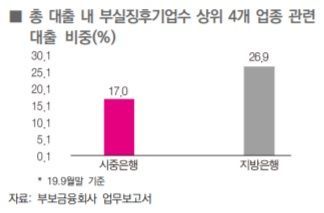

According to the Deposit Insurance Corporation on the 9th, the proportion of loans related to the top four industries with signs of insolvency estimated by the Financial Supervisory Service?machinery equipment, real estate, auto parts, and metal processing?accounted for 26.9% of total loans by regional banks as of the end of September 2019. This is about 10 percentage points higher than the 17% recorded by commercial banks.

The 'BooUlGyeong Belt'?comprising Busan, Ulsan, and Gyeongnam?and regions like Jeonbuk and Gunsan, which heavily depend on key industries such as automobiles and shipbuilding, were directly hit by the collapse of these industries, and the risks were fully transferred to regional base banks. The contraction of key industries led to worsening employment, a downturn in the self-employed business sector, and a slump in the real estate market, damaging the overall regional economy. The regional economic downturn is also confirmed by figures. According to Statistics Korea, the regional gross domestic product (GRDP) growth rates for Ulsan and Gyeongbuk last year were 0% and -1.1%, respectively. Although the business conditions are bottoming out due to the sluggishness of key local industries such as automobiles and shipbuilding, the recovery remains slow.

In the case of Gyeongnam Bank, a base bank in the BooUlGyeong Belt, soundness is noticeably deteriorating. According to the Financial Supervisory Service, the ratio of non-performing loans (NPLs) classified as fixed assets overdue for more than three months among corporate loans rose from 1.27% in September 2018 to 1.59% in September 2019. Among these, the NPL ratio for small and medium-sized enterprise (SME) loans increased from 1.12% to 1.56%, and for self-employed loans from 0.42% to 0.72%.

To make matters worse, as COVID-19 spread mainly in the Daegu and Gyeongbuk regions, the local economy sharply froze, and regional banks have been hit hard in both exports and domestic demand. SMEs have halted factory operations due to confirmed cases, and bottom-level economic activities such as self-employment have also stagnated due to avoidance of outings amid infection concerns. Daegu, where many COVID-19 cases have been concentrated, is in an economic paralysis. According to the Bank of Korea, the Consumer Sentiment Index (CIS), a current economic indicator, plummeted from 70 in January to 57 in February in the Daegu and Gyeongbuk regions this year. This is the largest drop since the MERS (Middle East Respiratory Syndrome) outbreak in May 2015, when it fell from 81 in May to 66 in June.

Regional banks based in this area, such as Daegu Bank, are expected to suffer significant damage. They face the dual challenge of expanding financial support to SMEs and self-employed individuals struggling with funding shortages to revitalize the regional economy, while also strengthening loan soundness management.

In particular, regional banks bear the burden of having a high proportion of loans to SMEs and self-employed individuals, who are vulnerable to economic slowdowns. DGB Financial and BNK Financial have SME loan ratios accounting for 60-70% of total credit, and self-employed loan ratios also exceed 20%, which is relatively high.

A financial industry official said, "Regional banks are experiencing a double burden as they face the expansion of insolvency due to the crisis in key industries and the unexpected variable of COVID-19. Although a surge in marginal SMEs and self-employed individuals is expected, financial support such as expanding new loans and extending maturities is inevitable to revitalize the regional economy, so concerns about future deterioration in soundness are real."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.