[Asia Economy Reporter Park Jihwan] The financial authorities announced that the Business Development Companies (BDC), scheduled to be introduced in the second half of this year, must mandatorily invest more than 60% of their assets in primary investment targets such as unlisted companies. Investment in KOSDAQ-listed companies and acquisition of partnership interests related to small and venture companies will also be allowed up to 30%. Participation of securities firms and venture capital as operating entities will also be permitted.

The Financial Services Commission announced on the 8th that it will give public notice of the amendment to the Capital Markets Act for "Revitalizing Private and Small Public Offerings and Introducing Business Development Companies (BDC)" containing these details.

This is a follow-up measure to the "Plan to Improve the Fundraising System for Innovative Companies through Capital Markets" announced on October 7 last year. The amendment will be finalized after collecting opinions during the public notice period (March 9 to April 20) and going through the legislative process.

The Financial Services Commission plans to introduce BDCs to stably supply sufficient funds to innovative companies in the growth stage. BDCs refer to investment entities listed on exchanges that raise funds from multiple investors and mainly invest in unlisted companies.

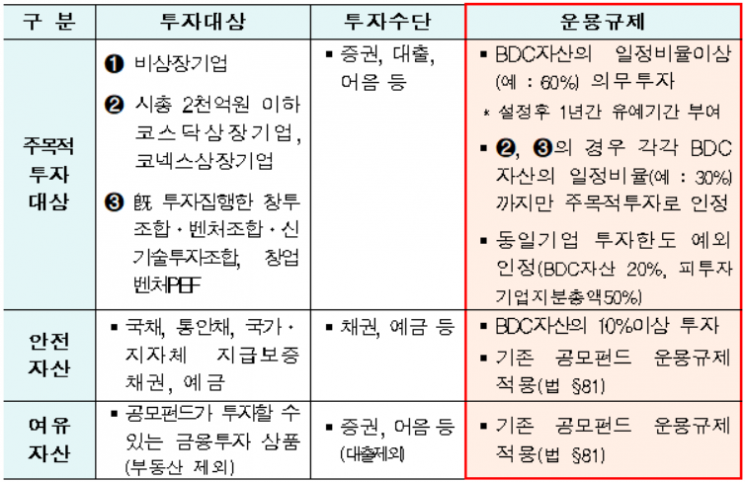

According to the amendment, BDCs must invest more than 60% of their assets in primary investment targets such as unlisted companies, KONEX-listed companies, and KOSDAQ-listed companies with a market capitalization of 200 billion KRW or less after establishment. However, investment in KOSDAQ-listed companies and partnership-type investment targets is recognized only up to 30%. In particular, a one-year grace period after establishment is given for the mandatory investment ratio.

Regarding BDC listing, the principle is to list within 90 days after establishment, but if the BDC is set up only with funds from asset management companies and professional investors, listing can be deferred for three years.

Entities eligible to operate BDCs include securities firms and venture capital in addition to asset management companies with a certain level of qualifications. The qualifications for operating a BDC include △ at least 3 years of management experience, an average annual custody amount of 150 billion KRW or more △ capital of 4 billion KRW or more, and at least 2 professional management personnel.

Additionally, the Financial Services Commission allows borrowing up to 100% of net assets for BDC operations and mandates that at least 10% of investments be made in safe assets such as government bonds and public bonds.

The Financial Services Commission explained, "We plan to finalize the government's proposal after reviewing opinions received during the public notice period and submit it to the National Assembly in the first half of this year."

The Financial Services Commission also plans to actively reflect market opinions during the process of revising subordinate regulations such as enforcement decrees while reviewing tax incentives for BDCs.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.