[Asia Economy Reporter Kwon Haeyoung] Concerns have been raised that the income security function of pensions could be undermined as early withdrawals from retirement pensions for the purpose of purchasing homes and rental deposit guarantees steadily increase. It has been pointed out that stabilizing housing prices and improving operational returns through the introduction of default options are necessary to ensure stable retirement income for the public.

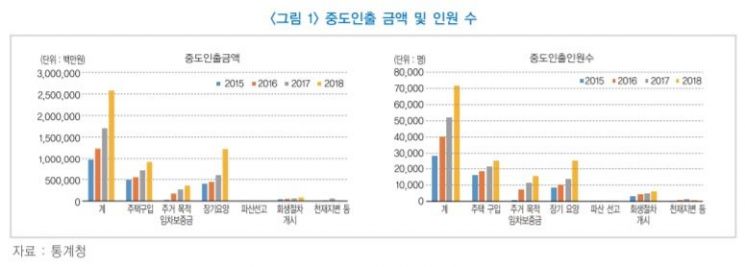

According to the "Trends and Implications of Early Withdrawals from Retirement Pensions" report released by the Korea Institute of Finance on the 7th, the amount of early withdrawals from retirement pensions for home purchase purposes nearly doubled from 500 billion won in 2015 to close to 1 trillion won in 2018.

Looking at the scale of early withdrawals from retirement pensions by reason in 2018, "long-term care" was the largest, followed by "home purchase," "rental deposit for residential purposes," "commencement of rehabilitation procedures," "damage due to natural disasters," and "bankruptcy declaration." Among these, the amounts withdrawn early for home purchase and rental deposit purposes have shown a steady increase.

In this regard, some argue that since home purchase and rental deposit for residential purposes are predictable and planned economic activities, regulations on early withdrawals are necessary. In particular, if retirement pension subscribers who have experienced rising housing prices expect prices to continue increasing, there is a concern that the tendency to use early withdrawals from retirement pensions for home purchases may grow.

Kim Byungdeok, Senior Research Fellow at the Korea Institute of Finance, said, "Early withdrawals from retirement pensions for home purchase purposes are ultimately based on housing price forecasts, so if housing prices stabilize downward and fall below the operational returns on accumulated funds, early withdrawals may naturally stabilize. Therefore, creating a macroeconomic environment where housing prices stabilize is very important." He added, "Efforts to generally improve the operational returns on mid- to long-term retirement pension funds through measures such as the introduction of default options should also be pursued simultaneously."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.