Non-Regulated Area Pre-Sale Rights Prices Soar

Uijeongbu, Previously Left Out of House Price Rise,

Transactions with Premiums Occur One After Another

"Government Measures Doubled Prices from 40 Million Won Range a Month Ago"

[Asia Economy Reporter Onyu Lim] Due to the balloon effect of real estate measures targeting Seoul and southern Gyeonggi Province, the value of apartment pre-sale rights in non-regulated areas of the metropolitan area is soaring. Even Uijeongbu, which had been left out of the rising housing price trend, has seen premiums of over 100 million KRW attached to 59㎡ (exclusive area) pre-sale rights. As investors seeking short-term capital gains turn their attention to non-regulated areas, there are concerns that actual homebuyers may suffer losses.

According to the real estate brokerage industry on the 6th, at Uijeongbu Uijeongbu Station Central Xi & Weave Castle, where resale restrictions were lifted on the 5th, 59㎡ pre-sale rights were traded one after another with premiums of 100 million to 110 million KRW above the pre-sale price. This complex, redeveloping Uijeongbu Central Living Zone 2, is close to Uijeongbu Station where the metropolitan wide express railroad (GTX-C) will stop, and with a total of 2,473 households, it was considered the flagship complex in Uijeongbu.

A representative of nearby A real estate agency said, "Just a month ago, we expected the premium on 59㎡ to be around 40 to 50 million KRW, but it sold for twice that amount," adding, "All 59㎡ units are now sold out, and only one 84㎡ unit with a premium of 170 million KRW remains." Nearby brokerage offices explained that after the 2.20 real estate measures, as prices of new apartments in Uijeongbu showed signs of rising, the number of pre-sale rights listings sharply decreased.

Uijeongbu was a region overlooked in the real estate market just a few years ago. While the housing price surge triggered in Seoul’s Gangnam area spread to southern metropolitan areas such as Suwon, Yongin, and Seongnam, there was little movement in Uijeongbu. However, recently, idle funds in the market, unable to find suitable investment destinations, have begun turning their attention to this area with transportation benefits such as GTX. It is also analyzed that the balloon effect caused by the expansion of regulated areas and strengthened loan regulations under the 2.20 measures influenced this trend.

In particular, pre-sale rights in non-regulated areas attract short-term investors because they have fewer transaction restrictions, relatively lower prices, and can be purchased by paying only the contract deposit of about 10% of the pre-sale price plus the premium. In fact, in Seoul, the pre-sale rights market was closed in March 2017 due to the 6.19 measures, and resale was virtually banned in regulated areas by the 2.20 measures. This has increased the scarcity value of pre-sale rights in non-regulated areas.

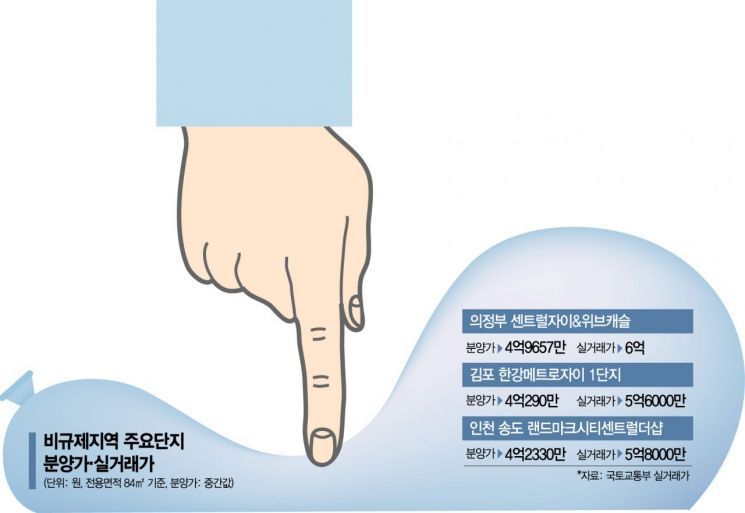

Strong demand for pre-sale rights is also evident in other non-regulated areas such as Gimpo, Incheon, and Bucheon. For example, the price of an 84㎡ pre-sale right in Hangang Metro Xi Phase 1 in Geolpo-dong, Gimpo City, Gyeonggi Province, rose from 500 million KRW in January to 560 million KRW in February. A representative of nearby B real estate agency said, "Investors are coming from all directions, making it difficult even to secure pre-sale rights," adding, "Some actual buyers gave up on transactions due to the large gap between expected and actual prices." The pre-sale right for an 84㎡ unit in Landmark City Central The Sharp in Songdo International City, Incheon, also surged from 490 million KRW in January to 580 million KRW in February, a 90 million KRW increase in just one month.

Jang Jaehyun, head of Real Today, said, "The rise in the value of pre-sale rights in non-regulated areas due to the balloon effect of the 2.20 measures was an expected result," adding, "However, these areas may see prices fall faster than Seoul or metropolitan areas with good accessibility during a real estate downturn, so careful judgment is necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.