[Asia Economy Reporter Jeong Hyunjin] Central banks around the world have found themselves in a dilemma following the Federal Reserve's (Fed) sudden interest rate cut. The pressure on central banks to step in to prevent economic damage caused by the novel coronavirus (COVID-19) has intensified, but concerns have arisen that unlike the Fed, they lack the 'ammunition' to use rate cuts effectively and that the effects may not be immediate.

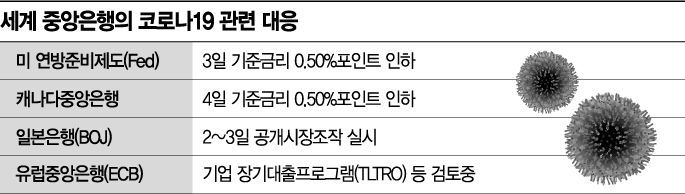

According to major foreign media on the 4th (local time), the Bank of Canada lowered its benchmark interest rate by 0.5 percentage points from 1.75%. This rate cut came just one day after the Fed's dramatic 0.5 percentage point cut. The Bank of Canada stated, "COVID-19 is having a materially negative impact on the economic outlook for Canada and the global economy," adding, "We are prepared to take further monetary policy measures if necessary to support economic growth and maintain our inflation target."

◆ 'Cautious Approach' Emerges... Market Expects Rate Cuts = The Group of Seven (G7) central banks agreed on the 3rd to deploy all possible policy tools to prevent a recession, but in reality, there are not many policies left to use. It takes more than a year for the effects of rate cuts to impact the market, and it is difficult to believe that rate cuts alone can resolve current issues such as supply chain disruptions and deteriorating consumer sentiment.

The Bank of England (BOE) is negative about rate cuts. Andrew Bailey, the incoming BOE Governor and current head of the Financial Conduct Authority (FCA), appeared before the Parliamentary Treasury Committee on the same day and emphasized, "At this point, we need more evidence to justify lowering rates," adding that it is better to wait until the economic damage becomes clearer. He suggested that economic support for supply chains would be more reasonable than monetary policy and placed emphasis on supporting small and medium-sized enterprises.

Especially in Europe and Japan, where negative interest rates are already in place, there is virtually no room left for further rate cuts. In fact, Robert Holzmann and Peter Kazimir, members of the European Central Bank (ECB), have officially expressed concerns about immediate responses. A source from the ECB told foreign media, "The market, media, and the Fed's rate cut are putting enormous pressure on us to act," adding, "We will move toward emergency measures but will try to hold out." He added, "We are not sure what we are doing. No one really knows the actual damage."

However, the market expects that they will eventually have no choice but to implement rate cuts. With International Monetary Fund (IMF) Managing Director Kristalina Georgieva stating that economic growth this year will fall below last year's level (2.9%) due to COVID-19, the pressure to take some form of action is increasing as the possibility of a real economic slowdown grows.

The ECB, which has a monetary policy meeting scheduled for the 12th, is predicted to lower the deposit rate, one of its policy rates, from -0.50% to -0.60%. Some speculate that, with a week left until the meeting, an emergency meeting might be held to cut rates sooner. HSBC and Nomura have assessed that the BOE may take emergency rate cut measures. The market is placing weight on the possibility that a rate cut decision could be made before the first monetary policy committee meeting chaired by Governor Bailey on the 26th. Nomura believes that if rates are cut by 0.25 percentage points this week, it could buy time to prevent economic slowdown at the meeting at the end of this month.

◆ Pressure Mounts Over 'Missed Opportunity'... Exploring Alternatives to Rate Cuts = Central banks are also exploring other options besides rate cuts. If no separate measures are taken and the economy falls into recession due to COVID-19, it will be difficult to avoid accountability. Moreover, since the Fed made a surprise rate cut, there is controversy over whether other central banks failed to act in time despite having the chance to respond earlier. The Wall Street Journal (WSJ) stated, "The Fed's rate cut is pressuring the ECB to unveil stimulus measures," and evaluated that "ECB President Christine Lagarde is facing her first test since taking office."

The market expects the ECB to implement additional long-term refinancing operations (TLTRO) that provide cheap loans to banks that increase lending to the real economy. It is anticipated that liquidity will be supplied specifically where needed. There is also speculation that the ECB will bring out its asset purchase program. The ECB is also emphasizing the need for fiscal policy.

The Bank of Japan (BOJ) first supplied liquidity to the market through open market operations on the 2nd and 3rd. Although it was the first open market operation in four years, only 30% of the planned amount (500 billion yen) was auctioned. This indicates that Japanese financial institutions did not have an urgent need to raise funds, and the BOJ views this as a message that it will intervene directly if there are problems in the financial market.

The Nihon Keizai Shimbun pointed out, "The financial shock that reached the real economy during the global financial crisis and the economic damage caused by the spread of COVID-19 shaking the financial market are different in terms of the effectiveness of monetary policy," adding, "With prolonged large-scale easing policies such as negative interest rates, the BOJ has few cards left. The difficulty of response may be higher than in 2008."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)