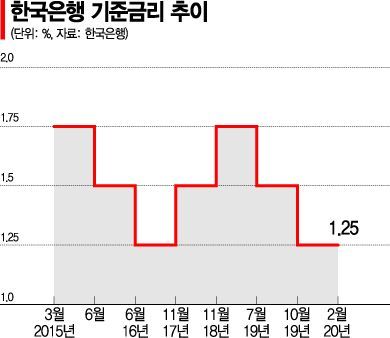

[Asia Economy Reporter Kim Eunbyeol] The Bank of Korea's Monetary Policy Committee (MPC) kept the base rate steady at 1.25% on the 27th of last month, but experts widely agree that there is a high possibility of a rate cut at the April MPC meeting.

Despite the heightened uncertainty due to the spread of the novel coronavirus infection (COVID-19), the MPC maintained a cautious stance; however, it is highly likely that the interest rate will be lowered in April when the impact on the domestic economy becomes certain. There is also an analysis that the timing of the rate cut will be aligned with the implementation of the government's supplementary budget (추경) to maximize its effect.

Gong Dongrak, a researcher at Daishin Securities, said, "The reason for this rate freeze is that the Bank of Korea prioritized financial stability in its monetary policy," adding, "I still believe there is a valid possibility of a future rate cut, and I expect the base rate to be lowered to 1.00% at the April MPC."

Kang Seungwon, a researcher at NH Investment & Securities, said, "The two dissenting opinions for a rate cut were maintained, and since the first-quarter economic indicators are expected to be significantly weak, I forecast a rate cut in April," adding, "The timing of the rate cut has been postponed to April, and it will be difficult to maintain a freeze throughout the year."

Baek Yunmin, a researcher at Kyobo Securities, also predicted, "In the situation where domestic economic uncertainty continues to grow due to the spread of COVID-19, the February MPC's monetary policy decision only temporarily postponed the timing of the base rate cut," and "The base rate will be lowered at the April MPC."

Kim Jiman, a researcher at Samsung Securities, also said, "I consider the rate cut to be a matter of time and expect a base rate cut in April," evaluating that "the Bank of Korea lowered its growth forecast and increased the limit on financial intermediary support loans, showing the need for economic response." He also predicted that the additional real estate regulations announced by the government last week and the won-dollar exchange rate rising to the 1,200 won level likely influenced the decision to keep rates steady.

Ahn Jaegyun, a researcher at Korea Investment & Securities, explained, "Although the government has planned supplementary budgets and various consumption stimulus measures, I believe these alone are insufficient to counteract the contraction in private consumption," adding, "There is a possibility of external shocks due to the global spread of COVID-19."

He said, "So far, micro-level responses have been effective, but the future situation does not look promising, and a rate cut is considered not an option but a necessity," forecasting a base rate cut in April.

Ahn Yeha, a researcher at Kiwoom Securities, also predicted a rate cut in April, saying, "Although financial stability factors such as rising real estate prices and increasing household debt are important considerations, it is questionable whether the Bank of Korea's projected 2.1% growth rate can be achieved," adding, "With the potential growth rate estimated at around 2.5%, a rate cut in the first half of the year is inevitable." The Bank of Korea lowered its growth forecast for this year from the initial 2.3% to 2.1% through its economic outlook.

The fact that COVID-19 is spreading across all continents and that there are forecasts that the U.S. may also cut rates adds weight to the speculation of a rate cut by the Bank of Korea.

Jerome Powell, Chair of the U.S. Federal Reserve (Fed), said in an emergency statement on the 28th of last month, "We will act appropriately and use our tools to support the economy," adding, "COVID-19 is increasing risks to economic activity."

In the U.S., concerns about the start of local COVID-19 infections caused the stock market to plunge, prompting the central bank chief to issue an unscheduled statement. Therefore, expectations are growing in global financial markets that the Fed may act as a savior.

South Korea's base rate is already higher than that of the U.S., and if the Fed does not cut rates, foreign capital may flow out, making a rate cut difficult. If a global trend of rate cuts begins with the Fed, the burden on the Bank of Korea to cut rates will also be reduced.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)