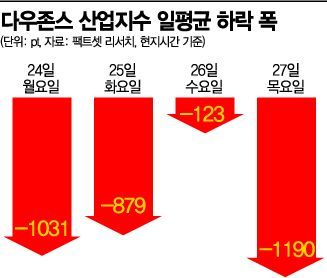

New York Stock Market Drops 10% in a Week... Local Infection Outbreak 'Maximizes Fear'

Fed Rate Cut Expectations Grow... Dollar Value Turns Weak Amid Rising Trend

Wall Street Fear Index CBOE VIX Surges 40%... Reflecting Market Anxiety

[Asia Economy New York=Correspondent Baek Jong-min, Reporter Kwon Jae-hee] The plunge in the U.S. stock market can be interpreted as the disappearance of a safe investment zone due to the novel coronavirus infection (COVID-19). Despite concerns over COVID-19, the U.S. stock market had been the only engine leading the global economy, powered by the boom in technology companies. However, as the U.S. stock market has continuously declined over the past week, investors can no longer find a clean investment zone.

In the New York stock market, the S&P 500 and Nasdaq indices had been hitting record highs daily until last week. However, a 10% drop within a week was somewhat shocking. Especially, although President Donald Trump tried to calm market fears at a press conference the day before, the fear was maximized as local infection cases, whose sources were difficult to identify, appeared immediately afterward. Gavin Newsom, governor of California where local infections occurred, revealed that 8,400 people are under observation, further dampening investor sentiment.

James Bianco, Chief Investment Officer of investment advisory firm Bianco Research, evaluated, "The current appearance of COVID-19 is shaking trust in the government." Although President Trump appointed Vice President Mike Pence as the chief person responsible for COVID-19 response, criticism continues over Pence's failure to properly respond to the HIV virus spread during his tenure as governor of Indiana.

The stock price decline also reflected the possibility of worsening corporate earnings. CNBC reported that stocks of Apple, Intel, and ExxonMobil recorded their worst performances, and AMD's stock price also fell more than 7%. American Airlines and United Airlines stocks dropped by 7.7% and 2.4%, respectively.

The preference for safe assets due to COVID-19 has intensified, increasing expectations for interest rate cuts by the U.S. central bank, the Federal Reserve (Fed). On this day, the 10-year U.S. Treasury yield fell to 1.25%, continuing its strong rally. A decline in bond yields means a rise in bond prices. The Chicago Mercantile Exchange (CME) FedWatch tool observed a 63.1% chance that the Fed will cut the benchmark interest rate by 0.25 percentage points in March. The current Fed benchmark rate is 1.5?1.75%, but the 10-year Treasury yield is lower than this, spreading the perception that the Fed will have to lower the benchmark rate to align with market interest rates.

As expectations for a Fed rate cut grew, the dollar, which had risen to its highest level in three years last week, turned weaker. The dollar index, which shows the value of the dollar against major currencies, fell 0.57% from the previous day to 98.375. The dollar value had risen recently amid safe asset preference, but the possibility of a rate cut acts as a factor for dollar depreciation.

Tu Lan Nguyen, analyst at Commerzbank, forecasted, "The dollar value could fall further depending on the economic impact of COVID-19."

The Chicago Board Options Exchange (CBOE) Volatility Index (VIX), known as Wall Street's fear index, also surged 40% on this day, reflecting market anxiety. This is the highest level since December 2018.

Jim Paulsen, Chief Investment Strategist at Leuthold Group, described it as a "panic state," saying, "This shows that investors are not temporarily retreating to buy at the bottom but have no intention to buy."

Due to the pandemic fear of COVID-19, global economic growth forecasts are being revised downward one after another. Kristalina Georgieva, Managing Director of the International Monetary Fund (IMF), stated, "The world economic growth forecast for this year was initially set at 3.3%, but it is lowered by 0.1 percentage points due to the spread of COVID-19."

Bank of America's outlook is even more negative. Bank of America Global Research forecasted this year's global economic growth rate at 2.8%. It is the first time since the 2009 global financial crisis that the global economic growth rate has fallen below 3%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)