DRAM Spot Prices Stall While Fixed Prices Rise

Supply-Demand Imbalance Expected to Worsen Due to COVID-19 Impact

[Asia Economy Reporter Changhwan Lee] As the novel coronavirus infection (COVID-19) spreads worldwide, the semiconductor market is experiencing fluctuations between hot and cold phases.

With the global economic slowdown deepening due to the COVID-19 crisis, the spot prices of semiconductor DRAM are falling, but fixed prices are rising as the possibility of a semiconductor supply-demand imbalance increases in the mid to long term. While the short-term business conditions are deteriorating, the mid to long-term outlook appears to be improving.

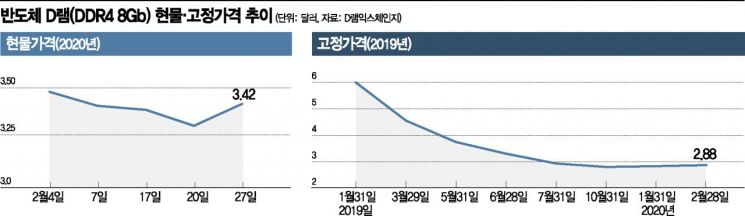

According to semiconductor market research firm DRAMeXchange on the 28th, the spot price of DDR4 8Gb DRAM was $3.42 as of the previous day. The spot price of DDR4 8Gb DRAM, mainly used in PCs, peaked at $3.48 on the 4th but has been declining since then.

It is analyzed that semiconductor spot prices are stagnating as demand for electronic products decreases due to the impact of COVID-19, coupled with sluggish transactions in the spot market.

The semiconductor industry expects that memory semiconductor shipments in the first quarter of this year will fall short of previous forecasts due to reduced product demand caused by COVID-19. Concerns have also arisen that corporate facility investments may be delayed compared to plans as the domestic situation worsens recently.

On the other hand, fixed prices for semiconductor DRAM continue to rise. Korean semiconductor companies such as Samsung Electronics and SK Hynix trade with customers at fixed prices, so the trend of fixed prices is more important than spot prices. According to DRAMeXchange, the fixed price of DDR4 8Gb DRAM was $2.88 on average as of the previous day.

This price is a 1.4% increase compared to $2.84 recorded at the end of the previous month, continuing an upward trend for two consecutive months since the end of last year. DRAMeXchange explained the price increase background by stating, "Companies are proactively securing inventory in anticipation of a future sharp rise in semiconductor prices."

It added, "With the recent rapid increase in COVID-19 confirmed cases in Korea, if production disruptions occur at Samsung Electronics and SK Hynix's memory semiconductor factories, it could lead to a rise in DRAM prices."

Semiconductor shipments this year are also expected to increase compared to last year. Global semiconductor market research firm IC Insights released a report the day before, forecasting that semiconductor shipments will reach 10.363 billion units this year, a 7% increase from the previous year in terms of quantity.

Worldwide semiconductor shipments started at 32.6 billion units in 1978 and have recorded an average annual growth rate of 8.6% up to this year. Especially in 2018, during a super boom, semiconductor shipments reached a record high of 10.46 billion units. Although this year’s shipments will fall short of that, they are expected to increase to the second-highest level ever.

IC Insights analyzed in the report that semiconductor demand will increase this year compared to last year due to advancements in smartphones, automotive electronics, cloud and big data computing systems, and artificial intelligence (AI).

However, the possibility of semiconductor demand contraction due to the impact of COVID-19 remains. Recently, the Philadelphia Semiconductor Index on the New York Stock Exchange fell nearly 12% over four consecutive trading days due to COVID-19. Many forecasts suggest that while semiconductor demand decreases and supply tightens, prices will show an upward trend.

Researcher Seungwoo Lee of Eugene Investment & Securities said, "Concerns among set manufacturers about tighter memory supply and demand in the second half of the year due to demand contraction caused by COVID-19 are growing," adding, "The expansion of uncertainty is expected to lead to an increase in fixed transaction prices."

He emphasized, "In the case of server DRAM, negotiations are underway for a double-digit price increase in the second quarter, and mobile DRAM prices are also likely to rise slightly in the second quarter."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.