Lime CI Fund Makes Split Repayments Four Times from March to June... Remaining Investment Repayments Expected to Prolong

40% of 13 Lime CI Fund Series Sold by Shinhan Bank Concentrated in July-August After Lime Controversy

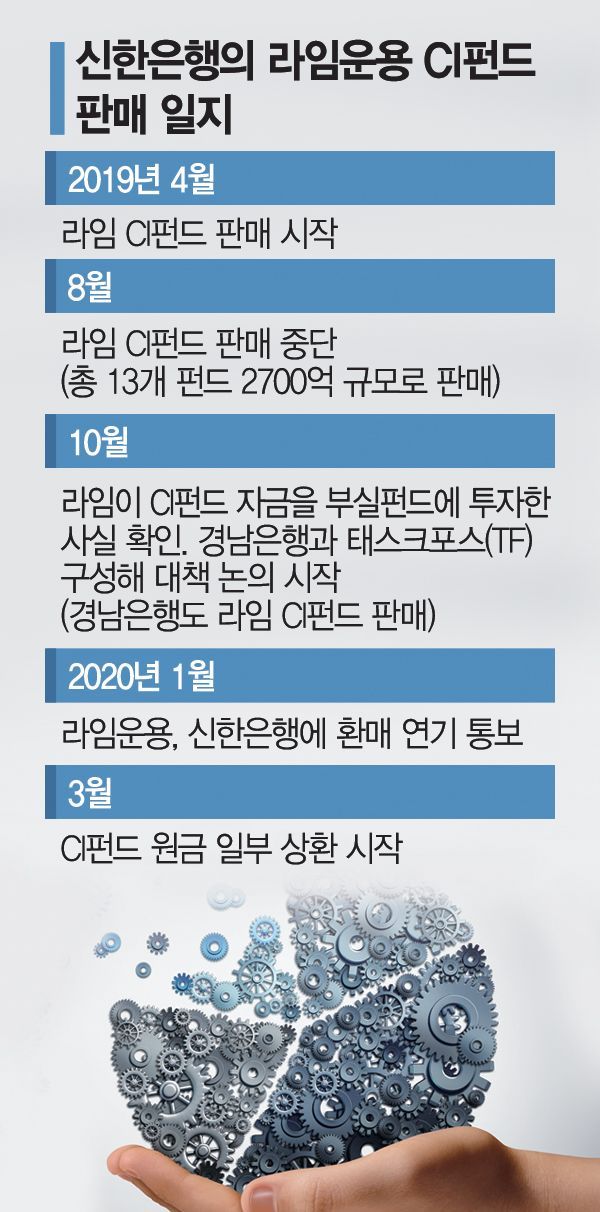

[Asia Economy Reporter Kwon Haeyoung] Shinhan Bank has informed investors that the funds from Lime Asset Management's Credit Insured (CI) fund, which it sold, have flowed into bad funds, and that the bank and the asset manager will prioritize repaying 50% of the principal over four months. Shinhan Bank sold the fund until the end of August, one month after suspicions of Lime Asset Management's fund yield recycling surfaced in July last year, and with the full principal repayment now uncertain, investor dissatisfaction is mounting.

According to the financial sector on the 28th, Shinhan Bank delivered a notice from Lime Asset Management on the 25th stating that from April, it will repay part of the investment funds to Lime CI fund investors whose maturity dates are approaching, in four installments from March to June.

In the case of Fund A, sold in June last year with a scale of 20 billion KRW, the principal and profits should be repaid when the one-year maturity comes in June, but the seller and asset manager have notified that only about 52% invested in normal bonds will be paid. They explained that payments will be split into 12% in March, 15% in April, 16% in May, and 9% in June.

Shinhan Bank sold a total of 13 series funds worth 270 billion KRW from April to August last year, but 7-30% of the fund's set amount flowed into two bad funds: Lime Pluto-FI D-1 and Lime Pluto-TF 1. When redemptions for these funds were abruptly suspended in October of the same year, the redemption delay of the Lime CI fund, which had invested about 100 billion KRW, became inevitable. Lime Pluto-TF 1 has not even undergone due diligence yet.

A Shinhan Bank official said, "Once the maturity of normal accounts receivable comes, we plan not to reinvest but to pay investors," adding, "We will start repayments as soon as investment funds are recovered even before the fund maturity to minimize investor damage."

Earlier, IBK Industrial Bank, which sold Lime Asset Management's bad funds in trust form, also recovered normal fund investments first in December last year, well before maturity, and returned part of the principal to investors.

Investors, who have only recovered half of their principal and face uncertainty in recovering the remaining funds, are expressing dissatisfaction. Although Lime Asset Management's misconduct triggered this situation, as the asset manager's payment capacity weakens, the blame is focusing on the seller, Shinhan Bank. Shinhan Bank claims that Lime Asset Management changed the management method without obtaining consent from the seller and investors, arguing that the seller is also a victim.

The timing of Shinhan Bank's fund sales is also controversial. The suspicions of Lime Asset Management's yield recycling arose in July last year when the prosecution began an investigation, and the Financial Supervisory Service started an inspection a month later in August. Shinhan Bank sold two Lime CI funds at the end of July and three at the end of August. This means 40% of the 13 series of CI funds sold by Shinhan Bank were sold after the Lime controversy broke out.

A Shinhan Bank official explained, "At that time, it was a problem with some funds due to the use of undisclosed information, not a general insolvency issue with Lime Asset Management's funds," adding, "According to the asset manager, it was a personal issue, and operations were normal until the end of September."

Meanwhile, Shinhan Bank and Gyeongnam Bank have been jointly discussing countermeasures since October last year after confirming that Lime Asset Management had incorporated part of the CI fund investment into bad funds. The sales scale is about 270 billion KRW for Shinhan Bank and about 12 billion KRW for Gyeongnam Bank. Lime Asset Management notified the sellers of the CI fund redemption suspension earlier last month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)