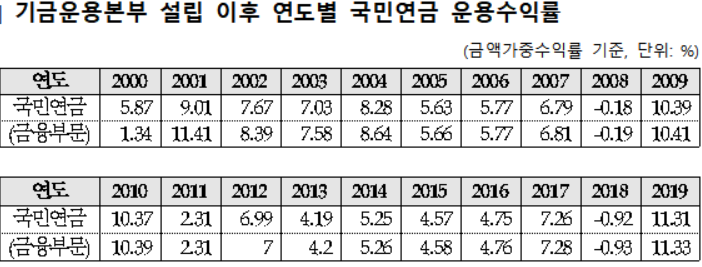

[Asia Economy Reporter Park Ji-hwan] The National Pension Service achieved an 11.31% rate of return through fund management last year. It earned approximately 73 trillion won in operating profits, marking the best performance since the establishment of the Fund Management Headquarters in November 1999.

According to the National Pension Service on the 27th, the annual fund management rate of return for 2019 was tentatively estimated at 11.3%. Despite uncertainties such as the trade dispute between the United States and China and Japan's export restrictions, the global stock market showed strength, largely due to interest rate cuts and economic stimulus policies by major countries worldwide.

The financial sector's rate of return was recorded at 11.33%. Returns included 12.58% for domestic stocks, 30.63% for overseas stocks, 3.61% for domestic bonds, 11.85% for overseas bonds, and 9.62% for alternative investment assets. In particular, overseas stocks showed a return exceeding 30%, buoyed by the global stock market rally following the news of the phase one trade agreement between the U.S. and China at the end of last year and the impact of exchange rates.

The National Pension Service's returns over the past 10 years were recorded as follows: 10.37% in 2010, 2.31% in 2011, 6.99% in 2012, 4.19% in 2013, 5.25% in 2014, 4.57% in 2015, 4.75% in 2016, 7.26% in 2017, and -0.92% in 2018.

Last year's fund management operating profit reached 73.4 trillion won. The cumulative profit accordingly amounted to 367.5 trillion won, accounting for half of the total National Pension Fund reserves. The National Pension Fund reserves increased by 97.9 trillion won from the previous year, reaching 736.7 trillion won.

The National Pension Service plans to maximize fund returns by further activating overseas investments to overcome the limitations of domestic market investments, as the fund size is expected to surpass 1,000 trillion won by 2024. Additionally, to ensure stable fund management, efforts will be made to strengthen the capabilities of the Fund Management Headquarters by expanding excellent investment professionals and improving infrastructure.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.