Before Reflecting the Rapid Spread of COVID-19

Automobile BSI Down 18P MoM

Sharp Decline in Electronic Imaging Communication Equipment, Metal Processing, etc.

Manufacturing Impact More Severe Than During MERS

[Asia Economy Reporter Kim Eun-byeol] Analyzing the 'February 2020 Corporate Business Survey Index (BSI)' announced by the Bank of Korea on the 26th by industry reveals that the novel coronavirus infection (COVID-19) is delivering a direct blow to both domestic demand and production. While domestic sectors only experienced short-term shocks during the 2015 Middle East Respiratory Syndrome (MERS) outbreak, this time the impact is more severe as it adversely affects the export and manufacturing sectors, which constitute the majority of South Korea's economy. This is also why the government's anticipated 'V-shaped recovery' is now overshadowed by uncertainty.

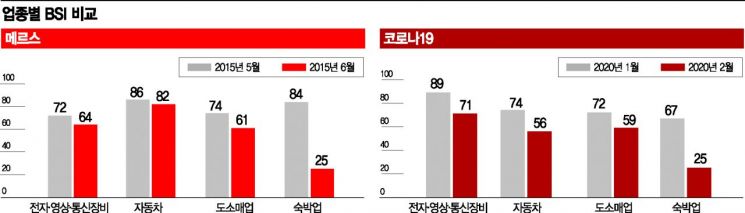

Specifically, the perceived business conditions sharply declined in the electronics, video, and telecommunications equipment sector (-18 points), automobile sector (-18 points), and metal processing sector (-11 points). The impact was widespread across company sizes as well. Large enterprises (-11 points), small and medium enterprises (-11 points), export companies (-13 points), and domestic companies (-10 points) all deteriorated simultaneously. This contrasts with the MERS outbreak period when the electronics, video, and telecommunications equipment sector BSI fell by only 8 points and the automobile sector by 4 points.

The Bank of Korea's February BSI survey was conducted from the 11th to the 18th. Therefore, although the index does not reflect the situation after COVID-19 rapidly spread domestically, the shock to manufacturing can already be confirmed. The reason lies in the collapse of China's global value chain (GVC). Due to the COVID-19 outbreak, China extended the Lunar New Year (Chunje) holiday and halted operations at some factories, causing difficulties for Korean companies in procuring intermediate goods and parts. Hyundai Kia Motors is a representative example. Kang Chang-gu, head of the Corporate Statistics Team at the Bank of Korea's Economic Statistics Bureau, explained, "Compared to MERS and Severe Acute Respiratory Syndrome (SARS), the impact on manufacturers is greater. Since our companies have many production bases in China and engage in processing trade, the manufacturing sector is more significantly affected."

A bigger problem is that the spread of COVID-19 has not ended here. As COVID-19 landed domestically, additional damage to manufacturing is already becoming visible. Samsung Electronics temporarily closed its Gumi plant, where smartphones are produced, after confirmed cases were reported. LG Electronics and LG Display also restricted access to some production workers at their Gumi plants. If further production stoppages occur in the manufacturing sector, which has already experienced a 'shut down' due to the China-originated parts shortage, damage across the entire industry will be inevitable.

Damage to the non-manufacturing sector is also bound to increase. The February non-manufacturing business performance BSI fell 9 points from the previous month, centered on wholesale and retail trade (-13 points), transportation and warehousing (-24 points), and accommodation (-42 points). Compared to the 11-point drop in non-manufacturing BSI during MERS, the situation is still manageable, but concerns remain if COVID-19 spreads further.

With all industries being affected comprehensively, analyses suggest that the government's initially expected 'V-shaped recovery' will be difficult to achieve. On the 17th, Hong Nam-ki, Deputy Prime Minister and Minister of Economy and Finance, stated during an economic department briefing that "COVID-19 is a temporary shock." This meant that when an infectious disease breaks out, the economy typically shows a 'V-shaped' pattern of sharp decline followed by recovery. However, at that time, there had been no confirmed cases for five consecutive days, and the situation has since changed. If South Korea's manufacturing sector comes to a halt, it could lead to a prolonged L-shaped recession rather than a V-shaped recovery.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.