Introducing Cards with Concentrated Benefits on OTT, Rental Services, and More

[Asia Economy Reporter Ki Ha-young] Card companies have launched a competition to dominate the subscription economy market, which is rapidly emerging as a new consumption culture. This involves offering discounts and rewards when paying for online video services (OTT), rental services, and more. The reason for entering the subscription economy is cited as the ability to secure long-term customers based on regular payments.

According to the card industry on the 25th, Hyundai Card recently launched 'Digital Lover,' which offers up to a 10,000 KRW discount on major digital streaming services such as YouTube Premium, Netflix, and Melon. Targeting the digital native generation, this card focuses on benefits for digital services like OTT. It also provides paid subscription services for shopping, travel, and digital content.

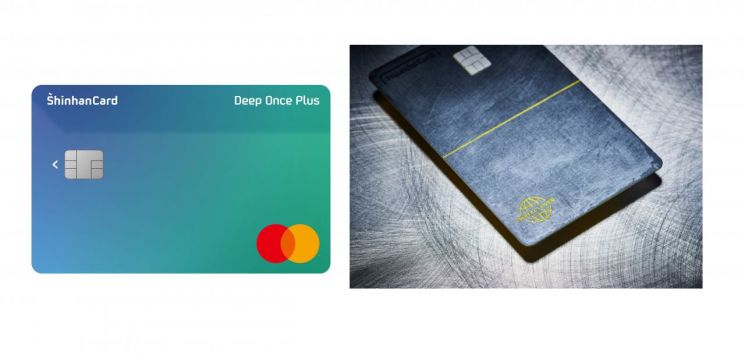

Shinhan Card also introduced the 'Deep Ones Card' earlier this month, promoting a total subscription economy service. When paying for home appliance rentals or online subscription products such as music sites and OTT with this card, points are accumulated. Previously, Shinhan Card became the first in the domestic financial industry to sign a partnership agreement with Netflix.

KB Kookmin Card launched the 'KB Kookmin Easy Link Titanium Card,' which offers benefits when paying for home appliance rental services or automatic utility bill payments. Samsung Card and Woori Card have also introduced products specialized for the subscription economy. Samsung Card's Number Card V4 accumulates 1,000 points per 100,000 KRW spent on automatic payments for apartment management fees, communication bills, gas bills, electricity bills, rental fees, four major insurances, and Netflix monthly subscription fees across 3 to 6 card products. Woori Card's 'Card of Jeongseok APT' offers discounts on automatic apartment management fee payments as well as 30% discounts on YouTube Premium and Netflix subscriptions. Hana Card created a 'Subscription Economy Department' through an organizational restructuring earlier this year.

The reason card companies are releasing new products related to the subscription economy is due to the growth of the subscription economy market and the customer retention effect. The subscription economy is a service where customers pay a monthly fee (subscription fee) and receive necessary products or services periodically. Recently, the scope has expanded beyond rental services and OTT to include fashion, health, and more. The growth is also steep. The market size doubled in 20 years from 215 billion USD in 2000. Global investment firm Credit Suisse forecasted the global subscription economy market size to reach 530 billion USD (approximately 625 trillion KRW) this year.

From the card companies' perspective, they can expect an increase in main customers through customers using the subscription economy. Since automatic transfer services are rarely changed, it can also prevent dormant customers from occurring. An industry official said, "The immediate profits from launching products related to the subscription economy are not large," but added, "In the long term, regular payments help maintain performance and turn customers into loyal users."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)