Bank of Korea February Consumer Sentiment Survey

Third Largest Decline in History Since Statistics Began

2015 MERS-Level Shock, Expected Inflation Rate Hits New Low Again

Consumer Sentiment Expected to Worsen Further Next Month

Increased Possibility of Bank of Korea Interest Rate Cut

[Asia Economy Reporters Eunbyeol Kim and Sehee Jang] Due to the impact of the novel coronavirus infection (COVID-19), consumer sentiment in February plummeted as sharply as it did during the Middle East Respiratory Syndrome (MERS) outbreak. The decline was the third largest since the statistics began being compiled.

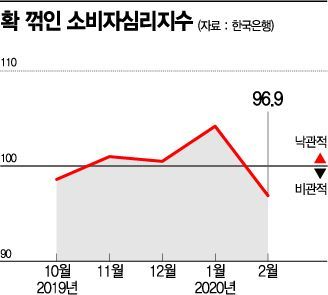

According to the 'February 2020 Consumer Sentiment Survey' released by the Bank of Korea on the 25th, the Consumer Confidence Index (CCSI) for this month fell 7.3 points from the previous month to 96.9. This is the lowest level in six months since August last year (92.4). A CCSI above 100 indicates that consumers are more optimistic than the long-term average (2003?2019). The CCSI fell below 100 for the first time in four months since October last year.

The decline was smaller than during the financial crisis in October 2008 (-12.7 points) and the Great East Japan Earthquake in March 2011 (-11.1 points). However, it showed a similar drop to June 2015 (-7.3 points), when MERS spread.

Since consumer sentiment had been improving since last year, this indicator is particularly painful. The Consumer Confidence Index had dropped to 92.4 in August last year, a level seen during the financial crisis, but then quickly recovered to 101.0 in November.

Looking in detail at the components of the overall index, all major indicators worsened. The Current Economic Situation Consumer Sentiment Index (CSI), closely related to the economic situation, recorded 66, down 12 points from the previous month (78). The Future Economic Outlook CSI fell 11 points from 87 to 76. The Employment Opportunity Outlook CSI dropped 7 points from 88 to 81 as economic perceptions deteriorated.

The Current Living Conditions CSI, which reflects consumers' financial situations, decreased by 2 points to 91, while the Living Conditions Outlook CSI (93), Household Income Outlook CSI (97), and Consumption Expenditure Outlook CSI (106) each fell by 4 points. Due to the government's 'Housing Market Stabilization Measures,' the Housing Price Outlook CSI (112) declined by 4 points.

Price perception remained steady at 1.8% compared to the previous month, but the expected inflation rate fell again to a record low of 1.7%. Kwon Cheo-yoon, head of the Statistical Survey Team at the Bank of Korea's Economic Statistics Bureau, explained, "Recently, consumer prices rose, causing expected inflation to rebound, but it appears that expected inflation fell again due to the negative impact on economic perceptions."

The February survey was conducted from the 10th to the 17th, before COVID-19 began spreading widely in South Korea. Therefore, there are forecasts that consumer sentiment may worsen further next month. Kwon said, "The current situation is not fully reflected yet."

As the shock from COVID-19 is reflected in economic indicators, the Bank of Korea is also moving urgently. Since the Business Survey Index (BSI) and Economic Sentiment Index (ESI), to be released on the 26th, are also expected to deteriorate, if the economic impact is confirmed to be significant, the Bank of Korea is likely to lower the base interest rate from the current 1.25% to 1.00%.

Im Seon, a researcher at Hana Bank Financial Investment Research Institute, said, "Considering the already released export indicators and consumer sentiment data, it seems difficult for the Bank of Korea to find justification to keep the base rate unchanged," adding, "The government is also taking all necessary measures, so it is likely that the Bank of Korea will coordinate its actions accordingly." Experts expect the Bank of Korea to lower its growth forecast to the low 2% range this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)