[Asia Economy Reporter Koh Hyung-kwang] Financial companies that sold Lime Asset Management's funds have earned over 50 billion won in fees over the past three years. Shinhan Financial Investment, which has been embroiled in allegations of incomplete sales, earned 13.5 billion won over three years.

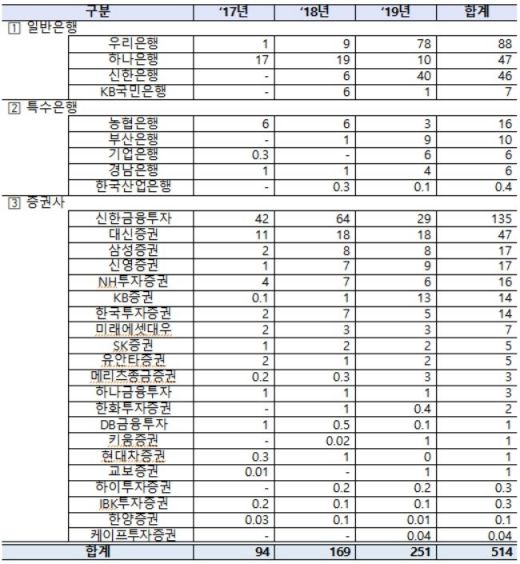

According to data submitted by the Financial Supervisory Service to Kim Sung-won, a member of the United Future Party, on the 25th, a total of 30 financial companies?21 securities firms and 9 banks (including 5 special banks)?were identified as having earned fees by selling Lime Asset Management's funds from 2017 to last year. The sales fees (including commissions) these financial companies received from customers for selling the funds amounted to 9.4 billion won in 2017, 16.9 billion won in 2018, and 25.1 billion won in 2019, totaling 51.4 billion won.

Among securities firms and banks, Shinhan Financial Investment earned the highest fees, totaling 13.5 billion won over three years. It earned 4.2 billion won in 2017, 6.4 billion won in 2018, and even amid the redemption suspension crisis last year, it received 2.9 billion won in fees from selling the funds.

Among securities firms, besides Shinhan Financial Investment, Daishin Securities (4.7 billion won), Samsung Securities (1.7 billion won), Shinyoung Securities (1.7 billion won), NH Investment & Securities (1.6 billion won), KB Securities (1.4 billion won), and Korea Investment & Securities (1.4 billion won) each earned over 1 billion won in fees. Additionally, most securities firms such as Mirae Asset Daewoo (700 million won), SK Securities (500 million won), Yuanta Securities (500 million won), Meritz Securities (300 million won), and Hana Financial Investment (300 million won) received fees in the hundreds of millions of won from selling Lime funds.

Among banks, Woori Bank earned the most with 8.8 billion won, followed by Hana Bank (4.7 billion won) and Shinhan Bank (4.6 billion won), each earning over 4 billion won in fees. Next were NongHyup Bank (1.6 billion won), Busan Bank (1 billion won), KB Kookmin Bank (700 million won), Industrial Bank of Korea (600 million won), Gyeongnam Bank (600 million won), and Korea Development Bank (40 million won) in that order.

Financial companies earn significant amounts in fees when selling various financial products. In the case of private equity funds, sales fees range from at least 1% to as much as 3% annually. Selling a 300 million won fund generates 3 million won in fee income on the spot. Most private equity funds charge a one-time fee at the point of sale. Additionally, commissions are settled over specific periods (6 months, 1 year, etc.) or at the final redemption point, with sales commissions taken by financial companies known to be about 1% annually of the fund amount. An industry insider said, "Due to Korea's distorted fund sales structure, upfront fees tend to be high," and pointed out, "Among funds, private equity funds are sold secretly, so fees are actually higher."

As of the end of last year, Lime Asset Management's parent funds with redemption delays numbered four, and the linked child funds totaled 173, with total assets under custody reaching 1.6679 trillion won. There are 19 child fund sellers in total, with Woori Bank (357.7 billion won), Shinhan Financial Investment (324.8 billion won), and Shinhan Bank (276.9 billion won) leading in sales amounts. By investor type, there were 4,035 individual accounts (994.3 billion won) and 581 corporate accounts (673.6 billion won).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.