[Asia Economy Reporters Koh Hyung-kwang and Oh Ju-yeon] Amid the stock market fluctuations caused by the novel coronavirus infection (COVID-19), individual investors have purchased nearly 6.8 trillion won worth of stocks in the Korea Composite Stock Price Index (KOSPI) market so far this year. In contrast, institutional investors have sold off stocks worth more than 8 trillion won, showing a completely opposite trend to individuals. As the domestic stock market was heavily shaken by external factors, individuals engaged in bargain buying while institutions expanded their selling by realizing profits.

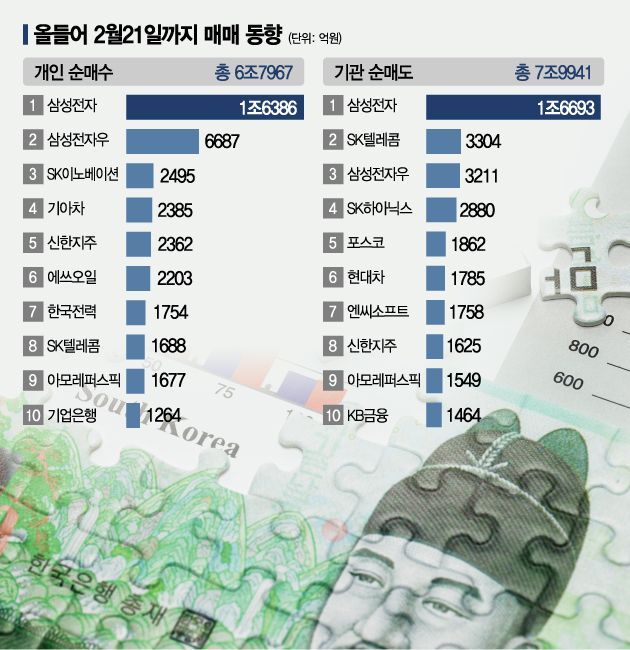

According to the Korea Exchange on the 24th, individual investors have net purchased a total of 6.7967 trillion won worth of stocks in the KOSPI market from the beginning of this year until the 21st. Following 4.483 trillion won in January, net purchases in February also reached 2.3137 trillion won. Notably, the net purchase amount in January is the largest monthly purchase amount by individuals since the Korea Exchange began compiling trading trend statistics by investor type in September 2001.

In December last year alone, individuals net sold 3.2295 trillion won worth of stocks, and throughout the past year, they sold a total of 11.8012 trillion won worth of stocks in the KOSPI market. However, this selling trend has dramatically reversed since the beginning of this year. Starting from the first trading day on February 2, individuals began buying stocks worth more than 530 billion won and showed a buying dominance on all but 10 of the 35 trading days. Even last week, when the KOSPI index dropped by 80 points due to the COVID-19 outbreak, individuals maintained net buying for five consecutive trading days, purchasing stocks worth 1.6 trillion won.

At the beginning of the year, military tensions between the U.S. and Iran escalated, followed by the outbreak of COVID-19, causing a series of major negative events. Nevertheless, individuals are buying 'fear' with expectations of a future rebound. Kim Yong-gu, a researcher at Hana Financial Investment, explained, "When SARS broke out in 2003 and MERS in 2015, the stock market experienced short-term corrections but eventually rebounded. This experience has greatly influenced investors' behavior."

On the other hand, institutions have been flooding the market with sell orders since the beginning of the year. Institutional investors net sold stocks worth more than 5 trillion won (5.0737 trillion won) last month alone, the largest amount since May 2009 when they net sold 5.6733 trillion won. In the past two months, including this month, they have sold off 7.9941 trillion won worth of stocks. This contrasts sharply with last year, when institutions net purchased 8.8567 trillion won in the KOSPI market, including 2.763 trillion won in December, helping to defend the index from decline. This year, institutions showed buying dominance on only seven trading days.

Institutional selling is led by the financial investment sector, including securities firms and asset management companies. Of the institutional sell volume, 86%, or 6.8698 trillion won, came from financial investment. Jeon Gyun, a researcher at Samsung Securities, explained, "Institutional investors net purchased 5.6 trillion won worth of KOSPI 200 spot stocks in November and December last year, but after the year-end ex-dividend date, they recorded net sales of 1.7 trillion won worth of KOSPI 200 spot stocks. This appears to reflect a supply-demand flow of liquidating profit-taking positions."

The stocks traded by individuals and institutions also showed stark differences. The stocks with net buying dominance by individuals included Samsung Electronics (?1.6386 trillion), Samsung Electronics Preferred (?668.7 billion), SK Innovation (?249.5 billion), S-Oil (?220.3 billion), Korea Electric Power Corporation (?175.4 billion), and SK Telecom (?168.8 billion), focusing on stocks with significant short-term price drops. Conversely, institutions realized profits mainly by selling stocks that individuals bought, such as Samsung Electronics (-?1.6693 trillion), SK Telecom (-?330.4 billion), Samsung Electronics Preferred (-?321.1 billion), SK Hynix (-?288 billion), POSCO (-?186.2 billion), Hyundai Motor (-?178.5 billion), NCSoft (-?175.8 billion), and Shinhan Financial Group (-?162.5 billion).

Foreign investors have maintained a cautious stance. After net purchasing 453.2 billion won in the KOSPI last month, they net sold 688.9 billion won this month, resulting in a net buying dominance of 148.4 billion won so far this year. Seo Sang-young, a researcher at Kiwoom Securities, explained, "The U.S. February Services Purchasing Managers' Index (PMI) fell below the baseline of 50 for the first time since 2015, highlighting concerns about a global economic slowdown, which has slowed foreign investors' movements. The rapid increase in domestic COVID-19 confirmed cases has also contributed to dampening investment sentiment."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)