[Asia Economy Reporter Kim Yuri] The government's determination to 'put out the urgent fire first' was reflected in the February 20 real estate measures. However, the market expects that this measure will not completely extinguish the flames, judging that the intensity has been moderated. Experts view it as a supplementary measure announced just two months after the December 16 measures last year, indicating a level of moderation. Above all, it is analyzed that a stronger and more proactive measure would have been a burden at a time just before the April general elections.

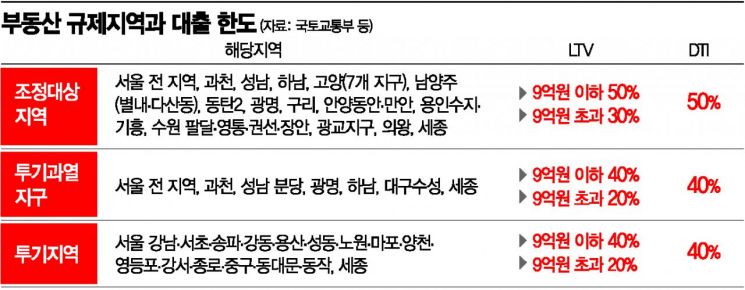

As a result, the market anticipates a second balloon effect. Quick-moving buyers, faced with additional regulations announced due to the rapid rise in housing prices in the Gyeonggi area led by Suwon, Yongin, and Seongnam (Su-Yong-Seong), have already been scouting for 'another non-regulated area with favorable conditions.' According to market expectations, some non-regulated areas may face additional regulations after the general elections based on government monitoring results. Existing adjusted target areas, which showed noticeable price surges but were excluded from this measure, are also expected to be designated as speculative overheating districts.

In the metropolitan area, there is a possibility that the 'matching height' phenomenon centered on the western region, including Ansan, Bucheon, and Incheon (Yeonsu and Seo-gu), or expectations of transportation network improvements in the western region, will continue to have an effect. According to Real Estate 114, the volume of sales and pre-sale rights transactions in these areas from November to December last year increased significantly compared to the same period the previous year. In Ansan Danwon-gu, sales transactions jumped 189%, and Manan-gu also rose 106.1%. Bucheon saw a 503.7% surge in pre-sale rights transactions, and Incheon increased by 168.1%.

Besides the metropolitan area, some localities such as Busan·and Cheongju may also stir. However, it is expected that the spread to outer Gyeonggi areas far from Seoul, like Pyeongtaek, where supply exceeds demand, will be limited.

The option to raise the regulation level in existing regulated areas still remains. According to the Korea Real Estate Agency, apartment prices in existing adjusted target areas such as Suwon Paldal-gu (6.32%),and Yongin Suji-gu (4.42%), Yongin Giheung-gu (3.27%), and Guri (2.31%) surged by 2-6% as of the 10th of this month. The Gwangmyeong area, which was a speculative overheating district, has also seen steady price increases since the beginning of the year. Whether additional measures will be taken will likely depend on future price movements in these existing regulated areas.

Experts agree that this kind of 'whack-a-mole style regulation' is likely to continue but also concur that this approach cannot be a fundamental solution. Kim Eun-jin, team leader of the Real Estate 114 Research Team, said, "The fact that additional measures were announced just two months after the December 16 measures ironically shows the limitations of demand-suppressing regulations," adding, "While demand suppression temporarily dampens demand sentiment, it is difficult to achieve fundamental price stabilization." Frequent regulations may instead increase market fatigue and build resistance as side effects.

Ham Young-jin, head of the Zigbang Big Data Lab, also said, "This time, the policy intensity was adjusted by strengthening regulations with pinpoint responses to localized balloon effects," adding, "In a situation where low interest rates and abundant idle funds flow into the housing market, it seems difficult to find sharp price stabilization measures other than monitoring housing prices, transaction trends, and subscription situations and designating additional regulated areas where overheating may occur or spread." Since liquidity is likely to flow into areas with transportation network expansions or various development prospects, where concerns about unsold units or oversupply are less, it is expected that additional government policies to curb the balloon effect in some metropolitan areas such as Gyeonggi and Incheon will be inevitable.

Ultimately, there is an analysis that alternative investment destinations for abundant market liquidity are urgently needed. Lab head Ham said, "It is necessary to discover publicly offered alternative investment destinations such as REITs and funds so that liquidity can move to various indirect investment products like small investments besides direct investments, and to normalize large city redevelopment projects that can soothe concerns about supply reduction in the market." Yang Ji-young, head of Yang Ji-young R&C Research Institute, said, "For long-term price stabilization, supply measures that facilitate smooth supply where there is demand must accompany demand suppression measures," adding, "It is urgent to specify plans such as the street housing redevelopment project and the revitalization of semi-industrial area development proposed in the December 26 measures, accelerate the development of the 3rd new town, and implement additional supply measures."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.