Support for New Loans, Maturity Extensions, and Principal Repayment Deferrals

Distribution of Masks, Hand Sanitizers, and Thermometers to Vulnerable Groups

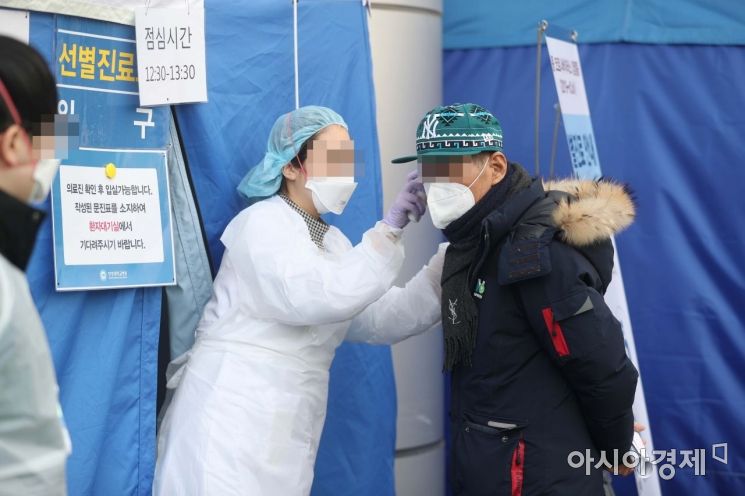

On the 19th, at the screening clinic of Hanyang University Hospital in Seongdong-gu, Seoul, where a COVID-19 confirmed patient without overseas travel history was reported, medical staff are checking visitors for fever. Photo by Mun Ho-nam munonam@

On the 19th, at the screening clinic of Hanyang University Hospital in Seongdong-gu, Seoul, where a COVID-19 confirmed patient without overseas travel history was reported, medical staff are checking visitors for fever. Photo by Mun Ho-nam munonam@

[Asia Economy Reporter Minyoung Kim] #.1 A wholesaler and retailer A (34), who imports and supplies clothing from China, requested a new loan from a domestic commercial bank due to financial difficulties caused by import and logistics disruptions and delayed payment of goods resulting from the spread of the novel coronavirus infection (COVID-19). After active review, the bank provided 70 million KRW in working capital on the 12th. A said, “I experienced difficulties due to temporary lack of funds, but I overcame the crisis thanks to the bank’s prompt support.”

#2. B, a 50-year-old restaurant owner, found it difficult to repay the planned loan as customers decreased due to concerns about COVID-19 infection. When B requested a loan repayment deferral from C Bank, the bank deferred repayment of 100 million KRW. Even those like B, who suffered indirect damage from COVID-19, can receive help from banks.

The banking sector has voluntarily established special support programs to provide funds to companies at risk of damage due to the spread of COVID-19. In addition, support for vulnerable groups is actively carried out as part of social contribution.

The Korea Federation of Banks announced on the 20th that banks have supported a total of 136 billion KRW (343 cases) in funds over eight business days from the 7th to the 18th by preparing programs to provide necessary funds to small and medium-sized enterprises, mid-sized companies, and small business owners who are expected to suffer direct or indirect damage from the COVID-19 situation.

Specifically, new loans amounted to 33.3 billion KRW (191 cases), maturity extensions 49.6 billion KRW (93 cases), principal repayment deferrals 25.2 billion KRW (26 cases), and preferential interest rates 700 million KRW (5 cases).

By industry, the lodging industry received the most support with 51.1 billion KRW (30 cases), followed by the restaurant industry with 25.1 billion KRW (36 cases), wholesale 10.6 billion KRW (59 cases), retail 1.9 billion KRW (22 cases), textile and chemical manufacturing 7.1 billion KRW (28 cases), and machinery and metal manufacturing 6.8 billion KRW (25 cases).

Also, the banking sector has carried out domestic and international social contribution projects worth about 4.6 billion KRW to prevent COVID-19.

Overall, the banking sector delivered 1.06 million masks, 29,000 hand sanitizers, 2,460 thermometers, and 400 relief kits to vulnerable groups. Emergency disinfection was supported at 416 child centers and traditional markets. So far, social contribution projects worth 2.4 billion KRW have been promoted.

Furthermore, to help flower farms suffering from a sharp decline in flower consumption and price drops due to cancellations of graduation and entrance ceremonies, various flower consumption promotion campaigns are being held. Through local bank branches in China, about 2.2 billion KRW in donations was delivered to support the rapid recovery of the severely affected Wuhan area in China.

The Korea Federation of Banks stated, “Domestic banks will continue to promptly provide emergency funds to affected companies and additionally prepare support measures to prevent the spread of COVID-19 and to revive the depressed local commercial districts.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)