[Asia Economy Reporter Eunmo Koo] According to this year's audit results, 24 listed companies will face the crossroads of delisting.

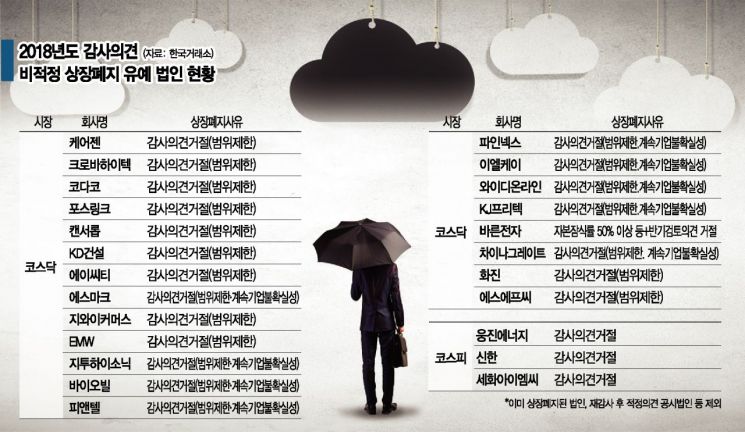

On the 20th, according to the Korea Exchange, a total of 37 KOSPI and KOSDAQ listed companies (with December fiscal year-end) received non-standard audit opinions (qualified, adverse, or disclaimer of opinion) when submitting their 2018 fiscal year business reports last year and were granted a one-year grace period for delisting. Among them, excluding companies that have already been delisted or those that voluntarily underwent re-audits and received standard audit opinions to resume trading, 24 companies (3 KOSPI and 21 KOSDAQ) will undergo delisting procedures if they receive non-standard audit opinions again this year. The market capitalization of these stocks amounts to a total of 2.1794 trillion KRW.

Looking at individual companies, Caregen, Clova Hightech, and Codaco faced delisting reasons last year due to audit opinion disclaimers caused by audit scope limitations. Similarly, KOSDAQ-listed companies such as Smark, Biovil, and P&Tel received audit opinion disclaimers as audit scope limitations combined with going concern uncertainties. In the KOSPI market, Woongjin Energy, Shinhan, and Sehwa IMC also received audit opinion disclaimers.

Previously, these companies were granted a one-year improvement period by the Corporate Evaluation Committee after non-standard audit opinions triggered delisting reasons last year, allowing them to maintain their listings. This was due to the Financial Services Commission's approval last year of amendments to the KOSPI and KOSDAQ listing regulations to reduce the burden on companies during the audit process.

Until then, companies receiving non-standard audit opinions were either immediately delisted or had to secure a standard audit opinion through a re-audit within six months. However, since last year, even if a company receives a non-standard audit opinion, it can be granted a one-year delisting grace period without undergoing a re-audit.

However, to protect investors, trading of these stocks remains suspended. Additionally, these companies must undergo audits by designated auditors appointed by the Securities and Futures Commission this year, and if the 2019 fiscal year audit opinion is again non-standard, delisting procedures such as orderly liquidation will proceed. Furthermore, even if the audit opinion is standard, trading can only resume after review by the Corporate Evaluation Committee.

Similarly, companies receiving non-standard audit opinions for the first time this year may face delisting risks next year. Especially since the revised External Audit Act, which significantly strengthened auditor responsibilities, has been applied since last year, audits have become more stringent, raising concerns that non-standard audit opinions will continue to surge this year.

Based on the 2018 business reports submitted last year, 33 companies (5 KOSPI and 28 KOSDAQ) triggered delisting reasons, an increase of 13 companies (65%) compared to 20 companies (2 KOSPI and 18 KOSDAQ) at the previous year's fiscal year-end. Additionally, Asiana Airlines experienced considerable confusion during the unusual process of receiving a qualified audit opinion among large business groups and then revising it back to a standard opinion.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)