Total Assets Over 5 Trillion KRW Large Business Group M&A Amount Decreases by 42.9%

M&A Amount Among Large Business Group Affiliates Also Drops 78.6% to 4 Trillion KRW

Overseas Companies' Domestic M&A Amount Increases by 94%

1.3 Trillion KRW Deal Between UK Est?e Lauder and Have & Be

200 Billion KRW Deal Between Hong Kong Tumbler Holdings and Twosome Place, etc.

"Delivery Hero-Woowa Brothers, Hanjoyang-Daejoyang Mergers Under Multifaceted Review"

[Asia Economy Reporter Moon Chaeseok] Last year, the amount of corporate mergers and acquisitions (M&A) among domestic large business groups (conglomerates with total assets of 5 trillion KRW or more subject to disclosure) decreased by 42.9% compared to the previous year, totaling 12.9 trillion KRW. Fines totaling 21.26 million KRW were imposed on 12 companies that violated the M&A reporting regulations, a 35% decrease from the previous year. The Korea Fair Trade Commission (KFTC) stated that it is conducting multifaceted reviews on mergers such as Delivery Hero-Woowa Brothers (delivery apps) and Korea Shipbuilding & Offshore Engineering-Daewoo Shipbuilding & Marine Engineering (shipbuilding industry).

On the 20th, the KFTC announced this through last year's "Corporate Merger Review Trends" report. Overall, domestic corporate mergers between affiliates decreased, with a notable decline in mergers between affiliates within large business groups, which signifies business structure reorganization.

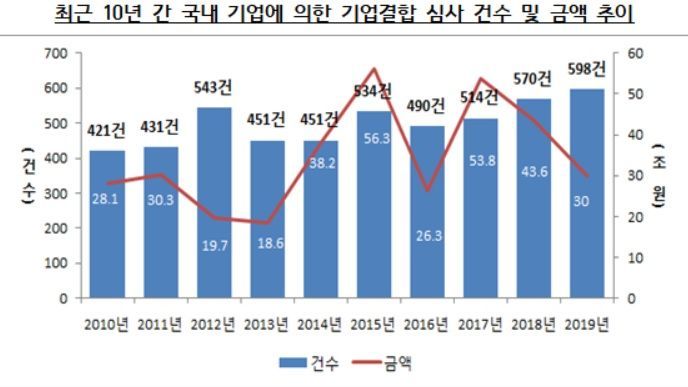

First, the number of domestic corporate mergers where domestic companies acquired domestic or foreign companies last year was 598, an increase of 28 cases compared to 2018. The total merger amount was 30 trillion KRW, down 32% (13.6 trillion KRW) from 43.6 trillion KRW the previous year.

For large business groups with total assets of 5 trillion KRW or more, the number of mergers was 166, down 20.2% (42 cases) from 208 the previous year, and the merger amount was 12.9 trillion KRW, a 42.9% decrease compared to the previous year.

The amount of corporate mergers refers to the amount paid as consideration for acquiring shares in stock acquisitions, the amount paid plus assumed liabilities in business transfers, and in mergers, the total issuance price of shares delivered to shareholders of the merged company plus the merger consideration amount.

Mergers between affiliates also decreased. The number of cases was 172, down 27 from the previous year, and the amount was 5.7 trillion KRW, a 76.3% (18.3 trillion KRW) decrease compared to the previous year.

The proportion of mergers between affiliates in total domestic corporate mergers was 28.8% (by number of cases), the smallest in the past five years. The proportion shrank from 35.6% in 2015, 34.1% in 2016, and 30.2% in 2017, then increased to 34.9% in 2018, before shrinking again to 28.8% last year.

The number of mergers between affiliates within large business groups with total assets of 5 trillion KRW or more was 69, down 37.8% (42 cases) from the previous year, and the merger amount was 4 trillion KRW, a 78.6% (14.7 trillion KRW) decrease compared to the previous year.

The number of mergers between affiliates within large business groups increased from 46 cases in 2016, 68 in 2017, and 111 in 2018, then decreased to 69 last year.

The proportion of mergers through stock acquisition increased, while the proportion of mergers by consolidation decreased. Comparing the methods of merger last year to 2018, the proportions of company establishment (21.2% → 27.8%) and stock acquisition (26.8% → 27.1%) increased, while mergers (27.9% → 23.4%), dual executive roles (11.8% → 10.2%), and business transfers (12.3% → 11.5%) decreased.

For large business groups, the proportions of stock acquisition (17.3% → 21.7%), company establishment (10.1% → 14.5%), and business transfers (18.3% → 19.2%) expanded, while mergers (40.4% → 30.7%) shrank.

According to the KFTC, there were a total of five corporate mergers last year that received corrective measures due to concerns over competition restrictions. These include the August case of SK Telecom and Content Alliance Platform, the October case of Global Tax Free and KTis, the November case involving Dongbang and Seongwang and two other companies, the November case of LG Uplus and CJ Hello, and the November case of SK Telecom and T-Broad.

The number of corrective measures by year showed a decreasing trend with 8 cases in 2015, 4 in 2016, 4 in 2017, and 3 in 2018, but increased to 5 cases last year.

Accordingly, fines totaling 21.26 million KRW were imposed on 12 cases that violated the corporate merger reporting regulations (either by missing the reporting deadline or failing to report).

According to the KFTC, if one party in a corporate merger has total assets or sales of 300 billion KRW or more in the previous fiscal year, and the other party has total assets or sales of 30 billion KRW or more in the previous fiscal year, the obligation to report the merger under the Monopoly Regulation and Fair Trade Act arises.

Meanwhile, last year, the number of corporate mergers by foreign companies was 168, with a total merger amount of 418.4 trillion KRW. The number of cases increased by 27.3% (36 cases) compared to 2018, while the amount decreased by 5.6% (24.6 trillion KRW).

The number of cases where foreign companies merged with domestic companies was 41, up 10.8% (4 cases) from the previous year, and the merger amount was 9.7 trillion KRW, a 94% (4.7 trillion KRW) increase.

The KFTC explained that European Union (EU) and U.S. companies showed relatively high interest in mergers with domestic companies. EU acquisitions of domestic companies numbered 11, and U.S. acquisitions numbered 8, accounting for 46.3% of the total 41 cases.

Major merger cases included the 1.3 trillion KRW cosmetics business merger between Est?e Lauder (UK) and Have & Be (Korea), and the 200 billion KRW coffee shop business merger between Tumbler Holdings (Hong Kong’s Anchor Equity Partners Group) and Twosome Place (Korea).

Meanwhile, the KFTC announced that it is conducting multifaceted reviews on mergers such as Delivery Hero-Woowa Brothers and Korea Shipbuilding & Offshore Engineering-Daewoo Shipbuilding & Marine Engineering.

A KFTC official said, "It is expected that M&A activities across industries will steadily increase this year as companies seek growth engines and business restructuring for selection and concentration in response to global market uncertainties." and "The KFTC will continue to conduct thorough and in-depth reviews of corporate mergers, and plans to review and process mergers without competition concerns within 20 days (excluding correction periods) whenever possible."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.