Follow-up Measures to the 'Measures to Secure Financial Resources for the Common People' Announced in December Last Year

Legislative Notice for the Amendment to the 'Act on Support for the Financial Life of the Common People' Conducted

[Asia Economy Reporter Kangwook Cho] The obligation to contribute to microfinance will be expanded to all financial companies handling household loans, including banks, insurance companies, and specialized credit finance companies. The dormant deposit contribution system will be improved into a 'long-term inactive financial asset transfer system' that is unrelated to the statute of limitations, and the protection measures for the rights holders of dormant financial assets will be strengthened. The internal management system and governance of the Microfinance Promotion Agency will also be reorganized to enhance transparency and accountability in fund management.

The Financial Services Commission announced on the 20th that it has prepared a revision bill of the "Act on Support for the Financial Life of the Underprivileged" with these contents and will conduct a legislative notice period from the 21st to April 1st.

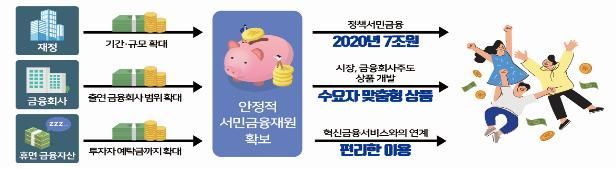

Looking at the main contents of the amendment, first, the scope of financial companies obligated to contribute to microfinance will be expanded from the current mutual finance and savings banks to all financial companies handling household loans, including banks, insurance companies, and specialized credit finance companies. This is aimed at establishing a policy microfinance support system encompassing the entire financial sector.

Contributions are divided into joint contributions proportional to household loans and differentiated contributions by industry proportional to guarantee balances. Detailed contribution standards, contribution rates, and procedures will be delegated to subordinate regulations. The government plans to contribute an additional approximately 190 billion KRW annually over the next five years from 2021 to 2025.

The dormant financial asset contribution system will be restructured into a system that transfers 'long-term inactive financial assets' regardless of the statute of limitations. The existing financial assets subject to contribution, such as deposits, insurance money, cashier's check issuance funds, and lost stocks, will be expanded to include investor deposits, and the term 'dormant deposits' will be changed to 'dormant financial assets' to encompass various assets.

Dormant financial assets are defined as those with no customer transactions for a certain period ('inactive period') from the maturity or last transaction date ('starting point') of each financial asset. This does not require the completion of the statute of limitations.

Customer notifications before transferring to dormant financial assets will also be strengthened. Customers will be informed at least six months before the inactive period expires that the assets may be transferred to the Microfinance Promotion Agency, and one month before the transfer, they will be notified of the scheduled transfer date and the return procedures after the transfer. Exceptions apply if the dormant financial assets are 100,000 KRW or less, or if the rights holder's contact information is unknown.

Additionally, the Microfinance Promotion Agency's efforts to locate owners will be made mandatory, and regular disclosure obligations on the status of dormant financial asset management will be imposed to enhance transparency. The use of the original dormant financial assets will be restricted to protect the rights holders' claims for return.

The Financial Services Commission explained, "The purpose is to protect customers' property rights by encouraging financial companies' efforts to return assets to customers and transferring only assets that customers have not claimed despite sufficient notification."

To enhance transparency and accountability in fund management, the internal management system and governance of the Microfinance Promotion Agency will also be reorganized. The management of dormant financial assets and related projects will be separated into a separate account (newly established Self-Support Support Account), and the concurrent holding of the chairperson of the Dormant Financial Asset Management Committee and the head of the Microfinance Promotion Agency will be abolished.

The Financial Services Commission plans to review opinions received during the approximately 40-day legislative notice period, finalize the government proposal, and submit it to the National Assembly around June to July this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)