[Asia Economy Reporter Minji Lee] As large-scale losses from derivative-linked funds (DLF) and the Lime incident have emerged consecutively, red flags have been raised over the credit ratings of securities firms. On the 20th, Korea Ratings released a report titled "The Impact of the Lime Fund Redemption Suspension Incident on Securities Firms' Credit Ratings," stating that multiple securities firms, including Shinhan Financial Investment and Daishin Securities, are involved in total return swap (TRS) contract structures, incomplete sales, concealment of defaults, and fraud allegations, and that their credit ratings could be affected depending on the level of compensation and fines.

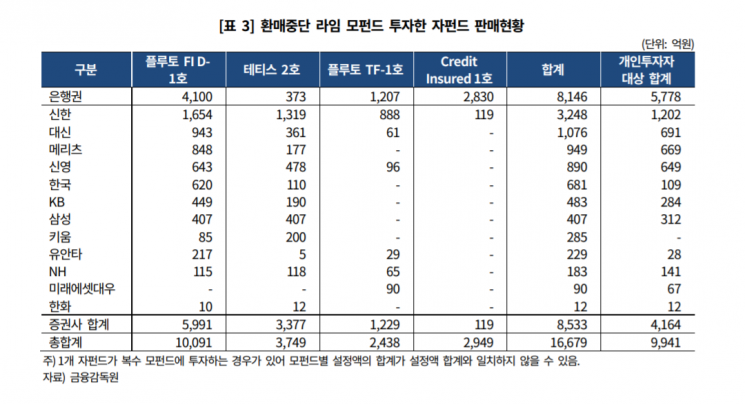

Currently, there are four funds suspended from redemption by Lime Asset Management (Pluto F1 D-1, Thetis No. 2, Pluto TF-1, Credit Insured No. 1), with assets under custody totaling 1.72 trillion KRW. The 173 sub-funds have assets under custody amounting to 1.67 trillion KRW.

Anna Young Ahn, Senior Researcher at Korea Ratings, said, “Despite the deterioration in the soundness of investment assets, unsound management, and inclusion of illiquid assets, these funds proceeded with open recruitment, which increased investors' losses. The recovery of funds lent through TRS contracts with Lime Asset Management, the presence of incomplete sales, and allegations of concealment of defaults are expected to impact the credit ratings of securities firms.”

In the case of the trade finance fund (Pluto TF-1), which is currently under due diligence, the proportion of TRS transactions relative to the book value of underlying assets is large, and losses are expected to occur even for the securities firms involved in the contracts. Once the loss rate exceeds 50% of the nominal amount of the mother fund, the securities firms involved in the TRS transactions will bear the losses.

If the compensation ratio is set high, the performance of securities firms with large sales volumes is expected to deteriorate significantly. Senior Researcher Ahn said, “Shinyoung Securities, Daishin Securities, and Shinhan Financial Investment, which have large sales volumes relative to their profit size, will be greatly affected. In particular, Shinhan Financial Investment and Daishin Securities, which may have legal violations, are expected to face even greater losses.”

As financial authorities are expected to supplement regulatory measures related to securities firms handling private equity funds and closely examine the firms’ own risk management systems, concerns have been raised that the scale of securities firms’ prime brokerage services (PBS) operations may shrink.

Senior Researcher Ahn explained, “Based on 2018-2019 data, net profits from PBS operations range from around 10 billion KRW to about 4 billion KRW, which is not a large proportion considering that the annual net profits of comprehensive financial investment business operators range from 250 billion to 600 billion KRW. However, concerns about business contraction are significant.”

Reputational damage and intangible opportunity losses due to restrictions on license acquisition are also negative factors for credit ratings. Since the revenue structure of the securities industry increasingly emphasizes investment banking (IB) and financial product sales, a decline in reputational capital could negatively affect business expansion and fundraising competitiveness. If designated as a subject for fines, restrictions on license acquisition are expected.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.