Labor and Management, "Let's Give Voluntary Retirement Pay Equivalent to Commercial Bank Employees"

Government, "Difficult Due to Fairness Issues with Other Public Institutions"

[Asia Economy Reporter Kim Min-young] Labor and management representatives and government officials gathered on the 19th to discuss the issue of early retirement at policy banks but failed to reach a clear conclusion. It is expected to take a considerable amount of time for labor, management, and the government to devise a solution regarding the virtually ineffective early retirement system at policy banks.

According to the government and financial authorities, a closed-door meeting on early retirement at policy banks was held in the afternoon at an undisclosed location in Jung-gu, Seoul, chaired by Moon Sung-hyun, Chairman of the Economic, Social and Labor Council. Representatives from three policy banks?IBK Industrial Bank of Korea, KDB Korea Development Bank, and the Export-Import Bank of Korea?along with labor union chairpersons, and officials from the Ministry of Economy and Finance and the Financial Services Commission attended. This was the second meeting since November last year.

While the first meeting served as an opportunity to initiate discussions on improving the early retirement system, this meeting involved the policy banks’ labor and management and the government stating their positions and listening to opinions.

It is reported that the heads of the policy banks actively expressed their views on the early retirement issue during the closed meeting. They emphasized that an increase in early retirees at IBK, KDB, and the Export-Import Bank would lead to more new hires at public institutions with higher wage levels.

A representative from the policy banks’ labor unions stated, “There is no significant difference in opinion between the three policy bank heads and the unions.”

Labor and management at the policy banks unanimously agreed that employees wishing to take early retirement should be allowed to leave the company with a certain amount of severance pay, similar to commercial banks. The argument is that high-wage employees who are effectively excluded from active duties should be given a path to opt for early retirement.

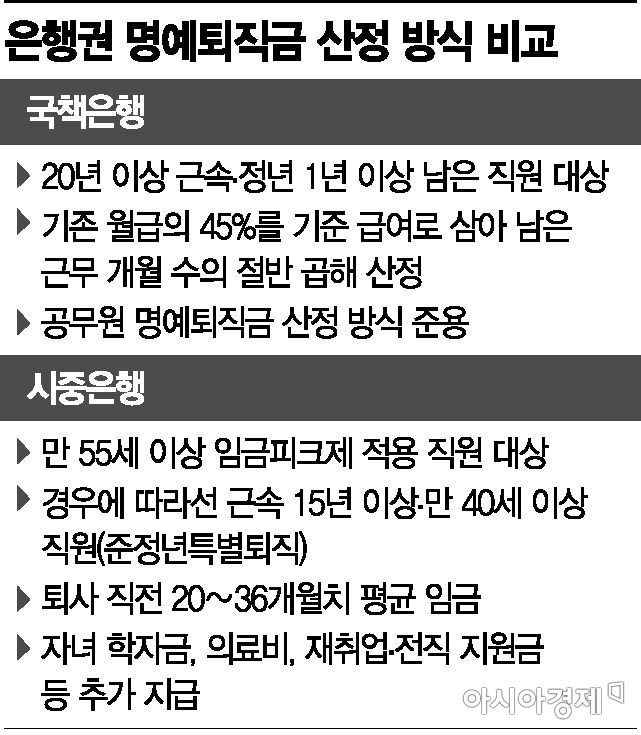

Currently, the calculation method for severance pay at public institutions follows civil servant regulations. This is because the Ministry of Economy and Finance mandated in 2014 that severance pay for public institution employees should, in principle, follow the civil servant severance pay calculation method. This applies to public institution employees with over 20 years of service and at least one year remaining until retirement. For example, if an employee has five years left until retirement, the severance pay is calculated by taking 45% of the monthly salary as the base pay and multiplying it by half of the remaining months.

Compared to commercial banks, which pay severance based on the average salary of the last 20 to 36 months plus additional payments for children’s tuition, medical expenses, and reemployment or career transition support, the severance pay at policy banks is relatively low. Commercial banks, which provide severance pay reaching hundreds of millions of won, allow not only employees aged 55 and above under wage peak systems but also those with over 15 years of service to apply for early retirement through special retirement schemes.

Given this situation, early retirement is rarely implemented at policy banks. From the employees’ perspective, it is more advantageous to choose the wage peak system, which guarantees retirement age despite reduced wages, rather than early retirement.

At IBK, which has about 13,500 employees in total, the number of employees under the wage peak system increased from 510 in December last year to 984 in 2021 and 1,027 in 2023. Since early retirement is not properly progressing, it is estimated that after a few years, one out of every ten employees will be out of active duty, effectively becoming “idle personnel.”

Yoon Jong-won, the new president of IBK Industrial Bank, is delivering his inaugural speech at the inauguration ceremony held on the 29th at the IBK headquarters in Euljiro, Jung-gu, Seoul. Photo by Kim Hyun-min kimhyun81@

Yoon Jong-won, the new president of IBK Industrial Bank, is delivering his inaugural speech at the inauguration ceremony held on the 29th at the IBK headquarters in Euljiro, Jung-gu, Seoul. Photo by Kim Hyun-min kimhyun81@

Yoon Jong-won, President of IBK, who attended the meeting for the first time, has repeatedly emphasized the need to expand early retirement. Before his inauguration, Yoon signed a labor-management declaration with the union to “resolve the early retirement issue promptly,” and told reporters, “There are fairness issues with other institutions and differences with competing institutions, so we will work jointly with other policy banks in similar positions to improve the problem.”

The Export-Import Bank of Korea shares a similar stance. There is a consensus between labor and management that it is difficult to reduce personnel by 10% by next year according to the 2016 innovation plan, given that early retirement has not been activated. An Export-Import Bank official said, “The proportion of employees under the wage peak system is expected to increase from 3.8% in 2018 to 6.7% in 2022, which poses problems such as decreased organizational productivity and reduced capacity for new hires,” adding, “Fundamental measures are needed to revitalize the organization and expand new employment for young workers.” Visiting Koo, President of the Export-Import Bank, has also maintained the need to introduce a special early retirement system with realistic severance pay levels.

The key lies with the Ministry of Economy and Finance. The Export-Import Bank is under the Ministry of Economy and Finance, while IBK and KDB are under the Financial Services Commission, but approval from the Ministry of Economy and Finance is essentially required to improve the early retirement system. The Ministry is reportedly reluctant to reform the policy banks’ early retirement system due to concerns about funding and fairness with other public institutions. As of the end of last month, there are 340 public institutions.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)