58% Sold by Banks Based on Individual Investors

Woori Bank Records Largest Sales Amount of 357.7 Billion KRW

FSS Focuses on Investor-Seller Dispute Mediation for Now

[Asia Economy Reporter Kim Hyo-jin] The large-scale redemption suspension and loss incident of Lime Asset Management's private equity fund is rapidly spreading as a controversy over incomplete sales by the banks that sold the funds, flowing like a 'DLF incomplete sales incident Part 2.' This is because more than half of the problematic funds were sold through banks. While investors who suffered damages have announced large-scale lawsuits, the financial supervisory authorities are currently focusing on procedures to mediate disputes between investors and sellers.

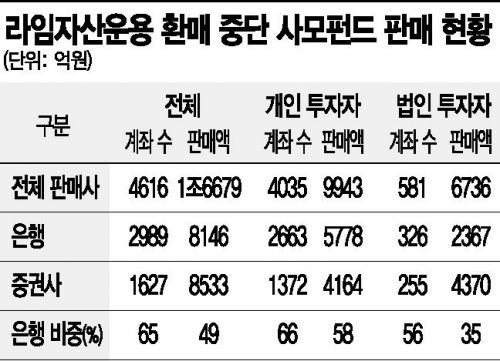

According to the financial sector on the 19th, out of the total trust assets of 1.6679 trillion KRW of 173 sub-funds invested in the redemption suspension parent fund, the amount sold by banks as of the end of last year was 814.6 billion KRW, accounting for 49% of the total. Narrowing the scope to individual investors excluding corporations, out of the total trust assets of 994.3 billion KRW, the amount sold by banks was 577.8 billion KRW, which is 58%. Woori Bank sold the most at 357.7 billion KRW, followed by Shinhan Financial Investment (324.8 billion KRW) and Shinhan Bank (276.9 billion KRW).

Compared to the bank sales ratio of the entire private equity fund market, this is nearly eight times higher. According to the Korea Financial Investment Association, as of the end of last year, out of the total private equity fund sales balance of 407 trillion KRW, the bank sales balance was only 25 trillion KRW, accounting for 6.22%. There are 4,035 individual investor accounts in Lime funds, of which 2,663 accounts, or 66%, were sold through banks.

The banking sector explained that the high reputation of investment products managed by Lime, the number one private equity fund company in Korea, had a significant influence. This demand was concentrated in banks, which have a much wider and denser sales (branch) network compared to securities companies. A financial sector official said, "If the net is large, the chances of entanglement are also high," adding, "As traditional business conditions worsen due to various loan regulations, competition intensifies, and banks seem to have actively jumped in."

Investors who suffered damages claim that banks and other sellers conducted incomplete sales without properly explaining the risk of loss. So far, 37 investors have sued Lime Asset Management and sellers through law firms: 34 through Law Firm Gwanghwa and 3 through Law Firm Hannuri. It is known that 2 investors have filed lawsuits individually.

Since investors have been notified of loss rates since the 17th, calls for compensation are expected to increase. Lime stated, "There is a possibility of recovery in parts previously judged difficult to collect bonds, so losses are not yet fully confirmed," but the general view is that the loss amount is unlikely to decrease significantly.

Lawsuits may be one way to recover damages, but many investors and sellers are currently watching the Financial Supervisory Service's dispute mediation process. The FSS's dispute mediation is considered more effective and faster than lawsuits, and if voluntary compensation proceeds in the future, it can be used as a standard.

The FSS has begun a full investigation process by requesting written explanations from sellers regarding incomplete sales suspicions based on more than 200 dispute mediation applications received. The FSS plans to form a joint on-site investigation team centered on the Dispute Mediation Division 2 and conduct on-site investigations of sellers starting next month.

Starting with trade finance funds, the FSS plans to review damage relief measures through legal advice in April and May, and hold a Financial Dispute Mediation Committee meeting by June to decide the compensation ratio. Considering the expected surge in dispute mediation applications, the FSS is operating a dedicated Lime dispute mediation window.

The FSS's investigation of sellers may lead to inspections based on the possibility of sanctions. Banks and other sellers are preparing lawsuits claiming they are also victims of Lime, so if dispute mediation fails, a muddy lawsuit battle among investors, sellers, and Lime may unfold.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)