[Asia Economy Reporter Lim Jeong-su] Glenwood Private Equity (Glenwood PE), a global private equity fund (PEF) management firm, is recruiting institutional investors to invest KRW 660 billion for the acquisition of a 54.1% stake in SKC Kolon PI. Due to favorable investment conditions such as profitability and stability, investor recruitment is reportedly progressing rapidly.

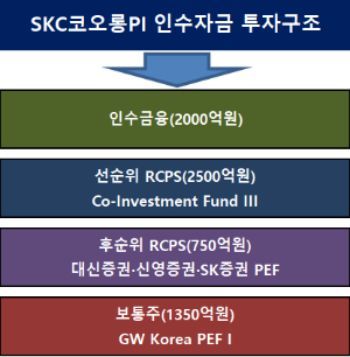

According to the investment banking (IB) industry on the 19th, Glenwood is establishing a special purpose company (SPC) to gather investors participating in the acquisition of SKC Kolon PI shares. The PEF created by Glenwood (GW Korea PEF No. 1) has agreed to acquire KRW 135 billion in SPC common shares. Additionally, it plans to borrow KRW 200 billion in the form of a term loan from a lending group consisting of banks and securities firms.

The remaining KRW 325 billion will be raised by the SPC issuing redeemable convertible preferred shares (RCPS). This includes KRW 250 billion of senior-class Type 1 RCPS and KRW 75 billion of subordinated-class Type 2 RCPS. The newly established 'Coinvestment Fund No. 3' will acquire the senior RCPS, while Daishin Securities, Shin Young Securities, and SK Securities PEF will each acquire the subordinated RCPS.

In particular, investors in the KRW 300 billion senior RCPS will receive an annual dividend priority of 3.5%. Furthermore, from the second year onward, they can receive early redemption of the RCPS at an internal rate of return (IRR) of 8% per annum. If early redemption is not exercised, investors can convert the shares and realize profits by selling the common stock. The expected return through share sales exceeds 10%.

The SPC will raise KRW 660 billion through this structure and pay KRW 610 billion as the acquisition price for shares to SKC and Kolon Industries. The remaining KRW 50 billion will be used for fund operation and management. An IB industry official stated, "The financing structure may be slightly adjusted during the investor recruitment process."

Investor recruitment is reportedly proceeding smoothly. Optimism about the growth potential of SKC Kolon PI is dominant, and the senior RCPS is analyzed to yield stable high returns compared to common shares and subordinated RCPS. An industry insider said, "The investment application volume is already full," adding, "Investor recruitment is in the final stages."

In December last year, Glenwood signed a stock purchase agreement to acquire all shares held by SKC and Kolon Industries, each holding 27.03%. Once the funds raised through acquisition financing are paid, the acquisition process will be completed. Upon completion, the shareholder structure will change with Glenwood holding 54.06% and other shareholders holding 45.94%.

SKC Kolon PI is the world's leading PI film specialist company. Its global market share is 30.7%, overwhelmingly higher than second-ranked companies such as Japan's Kaneka (19.8%) and the US's DuPont (12.2%). Including the Japan-US joint venture Toray-DuPont (11.0%) and Taiwan's Taimeide (10.3%), the top five companies maintain a global oligopoly with an 84% market share.

The oligopoly is expected to continue for a long time due to high entry barriers such as large-scale facility investment burdens and advanced technology. It is anticipated that SKC Kolon PI will expand its customer base beyond existing smartphone and semiconductor manufacturers to include 5th generation (5G) mobile communications, electric vehicles, displays, aerospace, and energy sectors.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.