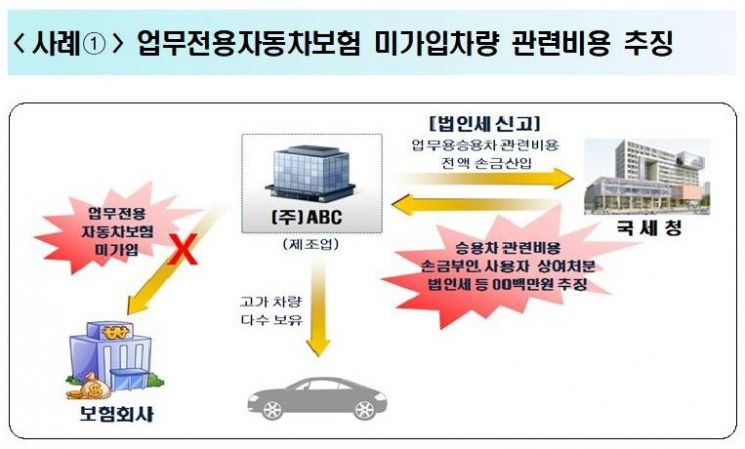

[Asia Economy Reporter Kwangho Lee] #Case 1= Company A, engaged in manufacturing, owns multiple high-end vehicles but did not subscribe to business-use-only automobile insurance for these vehicles. Nevertheless, it included all related expenses such as lease fees, fuel costs, insurance premiums, and automobile taxes as deductible expenses (tax law expenses) when filing corporate tax. The National Tax Service disallowed several hundred million won of related expenses for vehicles without business-use-only automobile insurance, treated the amounts as bonuses to the users, and imposed additional corporate tax and earned income tax amounting to tens of millions of won.

If high-end foreign cars are acquired under the names of corporations or individual business owners and used personally by the owner’s spouse or children, or for personal purposes such as golf or household matters, and all related expenses are claimed as tax deductions, tax evasion will be detected through tax audits or verification of filed contents, resulting in additional tax assessments.

The National Tax Service announced on the 19th that it has newly revised the "Expense Processing Standards" to assist with the tax treatment of business-use passenger car expenses.

The government has been implementing the "Special Expense System for Business-Use Passenger Cars" since 2016. This system aims to prevent private use of business vehicles by excluding compact cars, vans, commercial taxis, and freight vehicles, and to enable reasonable expense processing for vehicles used both privately and for business.

Corporate businesses must subscribe to business-use-only automobile insurance for the entire fiscal year. If not subscribed, all related expenses cannot be recognized as deductible. Individual business owners currently have no obligation to subscribe to such insurance, but from 2021, those subject to diligent reporting verification and professionals will be required to subscribe.

If one wishes to claim expenses proportional to the business-use ratio, driving records must be prepared and kept for each passenger car. There is an obligation to submit these records immediately upon request by the local tax office head. Business-use mileage refers to distances driven related to duties such as visiting manufacturing or sales facilities, client visits, attending meetings, promotional activities, and commuting. Driving for client entertainment or attending employees’ family events for welfare purposes also counts as business-use mileage.

To reduce the burden of maintaining driving records, expenses up to an annual limit of 15 million won are recognized even without preparing driving records.

Additionally, to prevent excessive deduction of depreciation or lease fees by purchasing or leasing high-end vehicles within a short period, the annual expense recognition limit is capped at 8 million won. For certain corporations that meet specific conditions, expense recognition limits have been reduced to prevent cases where family-owned companies acquire or lease luxury passenger cars for personal use despite operating in industries like real estate rental where business-use of passenger cars is minimal.

A National Tax Service official stated, "If business vehicles are used privately or related expenses are excessively deducted, we will conduct thorough verification through tax audits and filing content checks, so we urge sincere reporting."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)