Despite Rapid Increase in Market Liquidity, No Suitable Investment Destinations Found

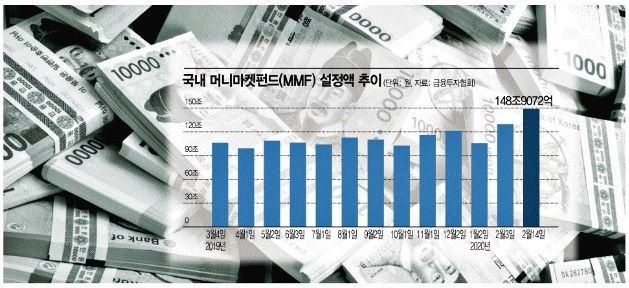

Concentration in Short-term Products like CMA... MMF Inflows Reach 44 Trillion Won This Year

[Asia Economy Reporter Eunmo Koo] As market liquidity rapidly increases, funds unable to find suitable investment destinations are flocking to short-term financial products. More than 20 trillion won has flowed into Money Market Funds (MMFs), a representative short-term product, since the beginning of this month, and over 1 trillion won has entered Comprehensive Asset Management Accounts (CMAs) during the same period.

According to the Korea Financial Investment Association on the 18th, as of the 14th, the total amount of domestic MMF assets stood at 148.9072 trillion won, an increase of 22.858 trillion won from the previous day. Funds have flowed into MMFs every single day this month without exception. During this period, the amount increased by 20.5145 trillion won, and expanding the scope to this year, the inflow reaches 44.0466 trillion won. The total balance of CMAs has also grown by more than 1 trillion won this month. As of the 14th, the CMA balance was 52.9122 trillion won, up 1.0841 trillion won from the beginning of the month. This is the highest level since April 26, 2018 (53.012 trillion won).

MMFs are ultra-short-term financial products that invest in short-term financial instruments to generate returns, allowing investors to earn interest income based on performance even if invested for just one day. They mainly invest in short-term financial products such as Commercial Papers (CP) and Certificates of Deposit (CD), distributing the returns earned. MMFs have no fees and can be redeemed at any time, offering higher yields than regular bank deposits, making them a representative product that absorbs short-term idle funds in uncertain market conditions. CMAs are also demand deposit accounts that invest deposits in bills or bonds and return the earnings.

The influx of money into short-term financial products fundamentally stems from abundant market liquidity. Recently, the money supply has been increasing at the fastest pace in about four years. According to the Bank of Korea, the broad money supply (M2), which includes cash, deposits, and short-term financial products, reached 2,912.4341 trillion won in December last year, up 7.9% year-on-year. This is the highest rate in 3 years and 10 months since February 2016 (8.3%). The M2 growth rate rose from 6.8% in August last year to 7.6% in September and has maintained a mid-to-high 7% range for four consecutive months. M2 is a broad monetary indicator that includes narrow money (M1) such as cash, demand deposits, and checking accounts, as well as short-term financial products like MMFs and fixed deposits under two years.

Although market liquidity continues to increase, the lack of suitable investment destinations is causing investment funds to accumulate in short-term financial products. Hwang Sewoon, a research fellow at the Korea Capital Market Institute, explained, "With the government's strengthened real estate regulations making it difficult for funds to move into the real estate market, and the stock market also sluggish due to the impact of the novel coronavirus disease (COVID-19), funds are maintaining a wait-and-see stance until the COVID-19 situation calms down, leading to inflows into MMFs."

The financial investment industry expects that if the stock market stabilizes and shows an upward trend again, short-term idle funds will move into the stock market. However, given the still high level of uncertainty caused by the COVID-19 situation, the amount of idle funds with a market-watching nature is likely to increase for the time being.

There are also calls for expanding investment incentives for companies to resolve idle funds in the market. When idle funds are connected to investments in companies, a virtuous cycle for economic growth can be formed. Research fellow Hwang emphasized, "It is especially necessary at the national economic level to establish channels that supply funds to relatively early-stage growth companies such as ventures. Although it is not easy, various tax support measures need to be considered."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)