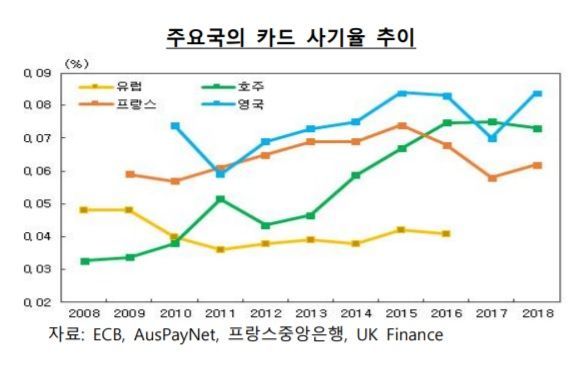

[Asia Economy Reporter Kim Eunbyeol] In 2018, the global amount of card fraud reached $27.85 billion (approximately 33 trillion KRW). The card fraud rate was recorded at around 0.07%.

According to the "Trends and Implications of Payment Instrument Fraud in Major Countries" published by the Bank of Korea on the 18th, losses due to account takeover and synthetic fraud caused by information leakage have been increasing as more personal information becomes available on the dark web.

Although non-face-to-face card transactions account for about 15% of total transaction amounts, they represented 54% of fraud losses. With the expected increase in cross-border e-commerce, losses from non-face-to-face card transactions are anticipated to rise rapidly. Fraud due to card counterfeiting decreased in 2018, but still accounted for a significant portion of card fraud in regions where EMV chips have not been introduced.

In Europe, losses and fraud rates from card fraud decreased from 2009 to 2011, then increased after 2012, but slightly declined again in 2016 following the adoption of EMV chips. In 2016, losses from card fraud in Europe amounted to 1.8 billion euros, with a loss ratio of approximately 0.041%.

In the United States, losses due to payment instrument fraud reached $8.34 billion as of 2015, with cards accounting for 77.5% of that amount. The card fraud rate was 0.108%, which is relatively high compared to other countries. Credit card fraud losses amounted to $5.14 billion.

The Bank of Korea pointed out that "in major countries, central banks and payment system operators regularly publish payment instrument fraud reports and statistics, and central banks actively intervene to prevent payment instrument fraud," emphasizing that Korea also needs to respond accordingly.

Payment instrument fraud reports and statistics are prepared by central banks in the US, France, and Europe; by banking and financial industry associations in the UK; and by small payment system operators in Australia. In Korea, the Financial Supervisory Service mainly publishes information related to account transfer fraud through voice phishing, but there are no comprehensive statistics covering major types of payment instrument fraud such as card fraud, check fraud, and account transfer fraud.

The Bank of Korea stressed the need to "establish statistics related to payment instrument fraud and prepare reports to understand and respond to rapidly changing fraud trends." Additionally, it called for strengthening protective measures such as consumer compensation, developing fraud detection and prevention techniques, and enhancing user education.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)