224 Billion This Year... Despite Recent COVID-19 Concerns, 161 Billion Attracted

[Asia Economy Reporter Minji Lee] Global equity funds are attracting investors' attention by shining despite concerns over the novel coronavirus disease (COVID-19). While domestic stocks are facing COVID-19 obstacles and showing a correction trend, the stock prices of innovative companies listed in developed countries are following an upward curve along with strong performance.

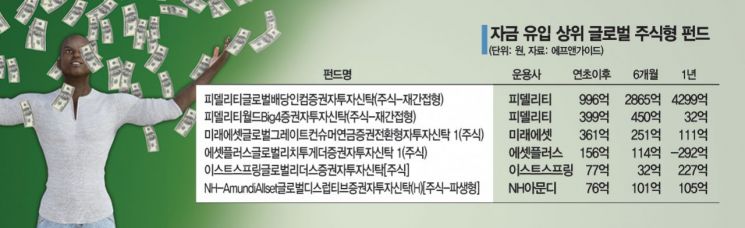

According to financial information provider FnGuide on the 17th, as of the 14th, 134 global equity funds have attracted 224.9 billion KRW in funds since the beginning of the year. Looking at the past month alone, despite the contraction of investment sentiment toward risky assets due to COVID-19 concerns, 161 billion KRW flowed into global equity funds. This contrasts with emerging market and Asian equity funds, which saw outflows of 21.7 billion KRW and 11.8 billion KRW respectively since the start of the year. During the same period, a total of 2.5818 trillion KRW exited domestic equity funds.

Global equity funds hold stocks listed not only on developed markets such as the U.S. and Europe but also in various other countries. To achieve returns higher than the benchmark index, they increase the proportion of U.S. stocks and fill the rest with stocks from China, Asia, and emerging markets.

Among the products with large capital inflows, the 'Fidelity Global Dividend Income Fund' and 'Fidelity World Big 4 Fund' attracted 99.6 billion KRW and 39.9 billion KRW respectively this year. The Fidelity Global Dividend Income Fund invests mainly in high-dividend stocks such as U.S. financial group US Bancorp (2.8%), German financial company Deutsche Boerse (2.8%), Taiwan's TSMC (2.6%), and Unilever (2.6%). Recently, it joined the ranks of large funds with net assets exceeding 1 trillion KRW. The Fidelity World Big 4 Fund diversifies investments equally with 25% each in the U.S., Europe, Japan, and Asia markets. Its holdings include AIA Group (2.4%), TSMC (1.9%), HDFC (1.8%), and Franco-Nevada (1.7%).

The increased demand for global equity funds is largely due to investors' growing desire to manage assets stably through country diversification.

Kim Hoo-jung, a researcher at Yuanta Securities, said, "Even in developed countries like Europe and the U.S., where funds have been established for a long time, there are many broad-concept funds rather than individual country funds. Managers can adjust country weights according to the situation to stably increase returns, so investor inflows are increasing into products with diversification effects, including EMP (ETF Managed Portfolio) funds."

The heightened investment expectations for U.S. innovative companies such as Microsoft and Tesla also had an impact. As leading U.S. tech stocks and innovative companies raised their stock prices due to strong earnings, investor interest grew. Tesla, an electric vehicle manufacturer, saw its stock price surge about 85% since the beginning of the year, driven by strong Q4 earnings last year and expectations for expansion into China.

Global funds also showed favorable returns. Since the beginning of the year, global equity funds posted a return of 4.63%, outperforming overseas equity funds (2.12%) and domestic equity funds (1.96%) during the same period. Over one year, global equity funds recorded 19%, overwhelmingly surpassing domestic equity funds (2.98%).

The funds with the highest returns were mostly those investing in innovative companies. The 'NH-Amundi Global Innovation Companies Fund' achieved a 9.94% return since the start of the year. This fund's portfolio consists of global innovative companies such as Salesforce.com (3.19%), Marvell Technology Group (2.81%), SolarEdge (2.7%), and TransUnion (2.7%). Additionally, the 'Mirae Asset G2 Innovator Fund' (8.9%) and 'Korea Investment Wellington Global Quality' (7.49%) also posted strong returns.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)