Last Year, 10 People Moved from Jeju to Seoul

"First Time Since 2009"

Retirement and Education Slow Jeju Living

Decrease in Population Moving from Seoul to Jeju

Jeju Apartment Prices Fell 3.66% Last Year

[Asia Economy Reporter Onyu Lim] For the first time in 10 years since 2009, the population moving from Jeju to Seoul has surpassed the population moving from Seoul to Jeju. This is the result of a decrease in relocation demand due to retirement and education. As the exodus from Jeju continues, Jeju apartment prices have also failed to recover.

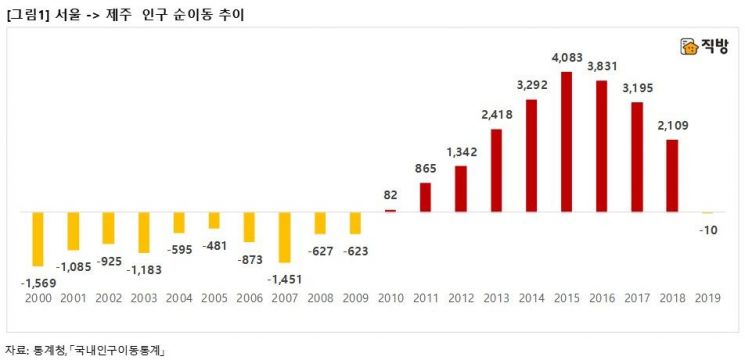

According to population movement data from Statistics Korea cited by Zigbang on the 17th, a total of 10 people net-migrated (inflow minus outflow) from Jeju to Seoul last year. It is the first time since 2009 that the number of people moving into Seoul from Jeju exceeded those moving into Jeju from Seoul.

Since 2010, living in Jeju has become a trend among retired seniors and residents of the Gangnam area enrolling their children in international schools, resulting in a continuous net outflow of population from Seoul to Jeju. In particular, with the massive influx of Chinese capital, the construction industry in Jeju was revitalized, and related industries emerged, leading to a peak net inflow of 4,083 people in 2015.

However, negative factors such as the THAAD incident, the enforcement of the ban on Korean cultural content in China (Hallyu ban), and rapidly rising housing prices have overlapped, gradually reducing the net inflow population. In 2015, 1,059 people net-migrated from the Gangnam 3 districts to Jeju, but in 2019, it was only 18. The net outflow of school-age children aged 10 to under 20 from Jeju to Seoul increased by 330% compared to 2015.

Zigbang analyzed, "The increase in net outflow to Seoul appears to be affecting apartment prices as well."

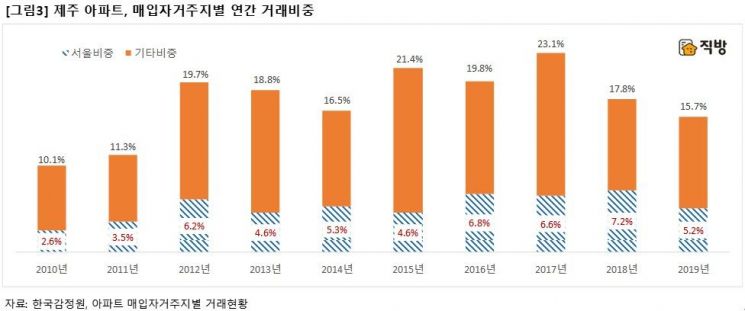

In fact, Jeju apartment prices, which rose as much as 13.78% annually in 2015, fell by 3.66% in 2019, underperforming the national average. For example, in Noheung-dong, where housing prices are the highest in Jeju, the actual transaction price of the I-Park 2nd complex for a 115㎡ (exclusive area) unit dropped from 1.117 billion KRW in July 2017 to 830 million KRW in August 2019. The 84㎡ unit also fell from 800 million KRW in February 2017 to 690 million KRW in April 2019. Zigbang explained, "Due to these effects, the proportion of investments by non-residents has also turned to a downward trend."

Since 2012, the proportion of apartments purchased by residents outside Jeju had exceeded 20%, but in 2019 it decreased to 15.7%. In particular, the purchase proportion from Seoul was only 5.2%, which seems to have contributed to the decline in non-resident purchases.

Ham Young-jin, head of Zigbang Big Data Lab, forecasted, "The weakness of the Jeju apartment market along with population outflow is expected to continue for the time being." This is because, with the stagnation of Jeju's tourism industry and a decrease in population inflow limiting housing demand expansion, transactions by non-resident investors focused on investment purposes are shrinking. Moreover, due to the strong Seoul apartment market, funds and demand that flowed into the metropolitan area are flowing out again. The rapid rise in apartment prices and job losses in Jeju prevent the working-age population from settling and cause them to move to the metropolitan area.

In Jeju, where the tourism industry is the mainstay, job opportunities are decreasing due to the reduced influence of Chinese tourists, while housing prices that once rose still maintain their asking prices, increasing the housing cost burden especially for young adults starting their careers.

Ham explained, "Although there are positive factors such as the Jeju 2nd airport construction issue and the lifting of the Hallyu ban, the impact is likely to be more focused on the land market rather than apartments, and it seems difficult to affect the Jeju apartment market in the short term."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)